Good Friday Morning from your Hometown Lender,

There is no data to speak of today and markets are left to their own devices.

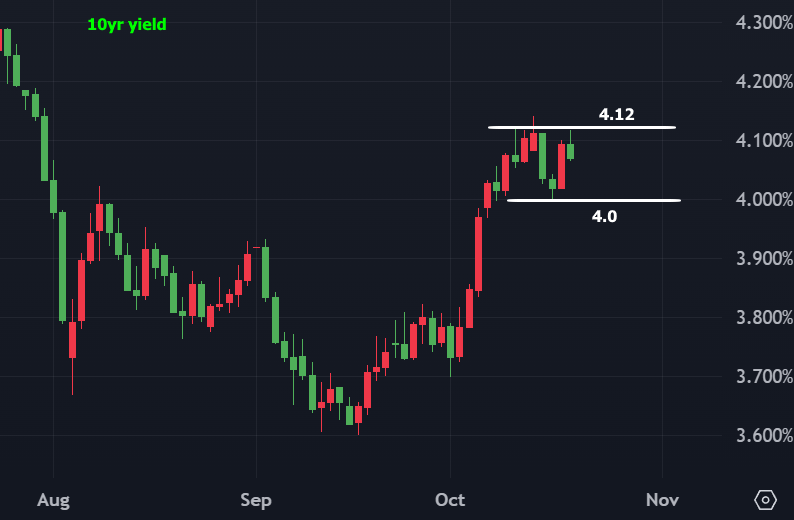

We are seeing a little bit of a rebound from yesterday’s selling, which is technically important as we do want to close below 4.07% on the 10-yr note. Doing so continues to keep the channel open for rates to drop .125-.25. Conversely, if we see selling into the end of the day, that then opens a new channel take us to 4.20 on the 10-yr, .125% worse. Right now things are calm. Let’s continue to hope they stay that way. Unless we see rates worsen and the 10-yr hit 4.10%, I am likely floating.

Matt Graham shared:

While the recent trend has been unpleasant for the bond market, at least it’s logical. Apart from some uncertainty related to the election and forthcoming Fed meeting, data drives all (to be fair, data drives the Fed as well). Thursday brought the week’s biggest supply of data with all the big reports being stronger than expected. Bonds logically tanked. Now today, there is no significant data so bonds have no reason to tank.

For those wondering why we’d say there’s no data today despite the release of Housing Starts/Building Permits, that’s because the new residential construction data hasn’t had even a modest impact on the bond market for well over a decade. This isn’t likely to change unless there’s another “crisis” type recession focused on the housing market. And even then, other housing-related data would be more likely to move markets than Starts/Permits.

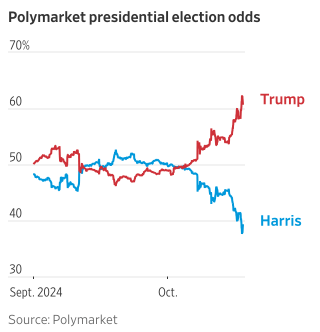

Election watch, Polymarket which is popular betting market for the election shows the current odds at:

Stay safe, enjoy your weekend and first, make today great!!!