Good Monday AM,

The hits keep coming as mortgage-backed securities are off another 20bps.

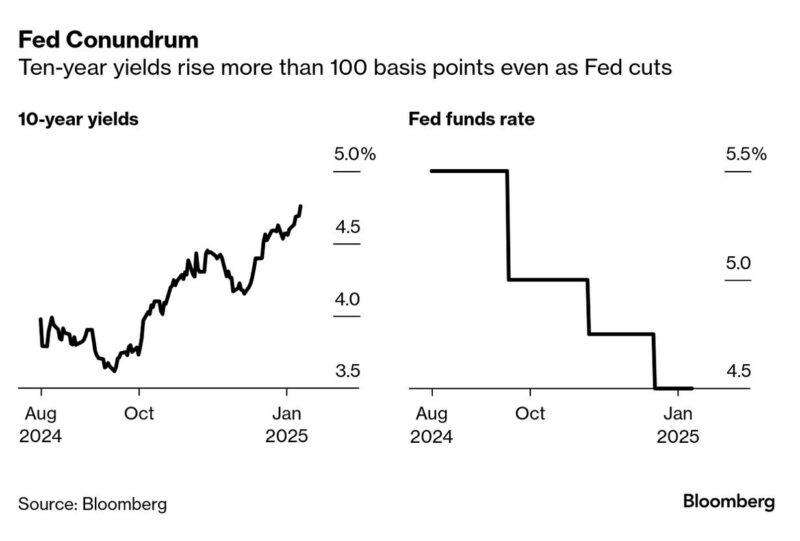

Uncertainty around the new administration’s policies is causing agita in the bond and equity markets. The 10yr note is sitting at 4.79% that is 110basis points higher than where we were in just September.

Rate sheets today will be even worse than Friday morning, but like any reprices worse that came as bonds lost ground on the day last week. Reprice risk on the day is moderate… bonds are flat to start the day, not recovering any of Friday’s losses yet, and we could see bonds continue to drift lower. Although the cyclic nature of bonds means we could see some rebound soon, that all could be kicked to the curb in the inflation data comes in hotter than expected on Wednesday. The current outlook for rates is that they will continue to move higher… and until that changes, risks favor locking.

Here is a quick and dirty summary on why we won’t see mortgage rates move lower from here…

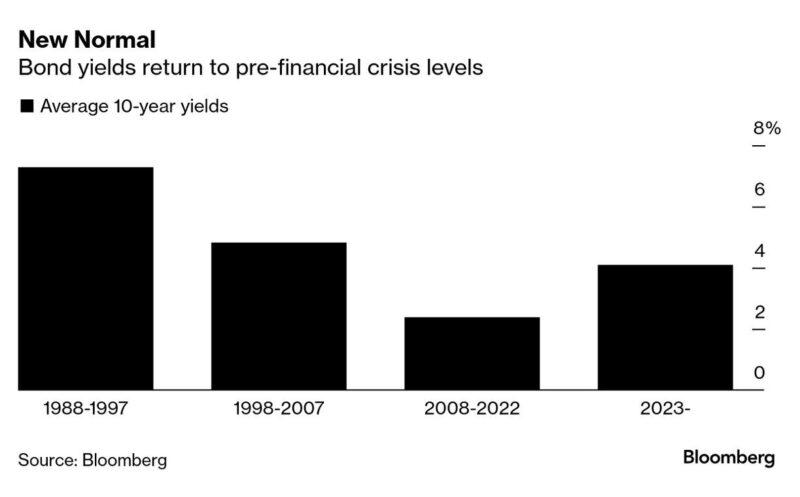

Bonds are selling off because of fears of persistent inflation and ballooning government debt levels. The Trump administration’s policies may help heat up the economy and reduce tax burdens, but it also will likely fuel inflation. A strong economy also means strong jobs, which is why rates surged Friday when the BLS jobs data came in so hot on Friday. Why there is at least a little hope that rates will soon stop rising… Traders are starting to question just how high US yields can go. The 10yr Treasury yield tested the 5% level back in October of ’23, which was also when we saw the highest mortgage rates in decades. Before then, the last time the 10yr and 5% yields were in the same sentence was during the Great Recession nearly two decades ago.

I am including two pieces below, one from the WSJ and the other from Bloomberg to share some high level insights.

Why bond yields are surging across the world

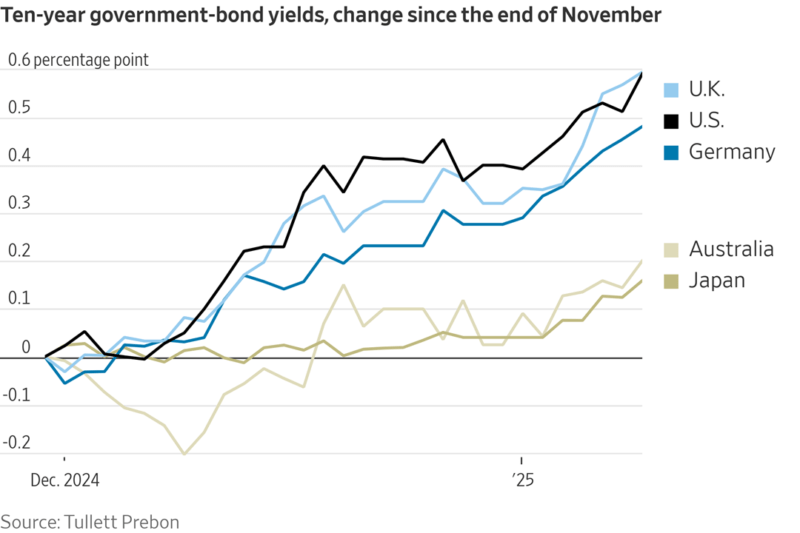

Government-bond yields have surged across the developed world in recent weeks, jarring stocks and pressuring indebted countries.

The worldwide bond rout threatens to complicate the efforts of central banks that have been cutting short-term interest rates. Rate cuts aim to lower borrowing costs for consumers and businesses.

But the rise in yields is instead making it costlier to borrow, “tightening financial conditions” in Wall Street parlance. The average 30-year U.S. mortgage rate rose to 6.9% last week.

Most analysts believe the U.S. has been driving the recent bond-market selloff.

Yields on U.S. Treasurys, which rise when bond prices fall, got their first big boost in October with the release of strong monthly jobs data that wiped away fears of a looming recession. Then Donald Trump won the U.S. presidential election promising policies that many investors believe are inflationary, and Federal Reserve officials shifted their forecasts to fewer rate cuts in 2025.

And… The surging price of money

If strategists at Bank of America are correct, the US bond market is now in the sixth year of the third great bear market since 1790.

Few investors would beg to differ after a week in which US Treasury yields soared, propelling the rate on the 10-year note to the brink of the 5% barrier rarely seen since the financial crisis of 2008.

Other nations are experiencing a similar exodus from debt. The yield on 30-year UK gilts last week touched the highest since 1998, forcing the new Labour government to start seeking money-saving measures, and UK assets are weak again today.

The message from many in markets, and Bloomberg’s latest Big Take, is to get used to it: The price of money will be permanently higher as risks to the supposedly safest of assets mount.

Friday’s blowout jobs report shows the economy continues to power ahead, leaving Bank of America among those on Wall Street now betting the Federal Reserve won’t cut interest rates in 2025. Goldman sees two reductions, down from three previously.

With data this week set to show inflation is staying sticky (see our week ahead below), central bankers are already signaling they’re on hold.

And we are now a week away from the second Trump presidency which lands with promises of lower taxes and higher tariffs. That’s a recipe, in the opinion of many, for faster inflation and greater debt. A fight also looms over lifting the federal debt limit.

Put it all together and it’s no wonder the so-called term premium on 10-year notes — the extra yield investors demand to accept the risk of taking on longer-term debt — is now at a decade high.

The result is BlackRock, T. Rowe Price and Bianco Research are among those penciling in 5% as a reasonable target for yields amid expectations investors will demand juicier rates to keep buying longer-dated Treasuries.

That has implications for other markets, with historians noting the multiple times that higher borrowing costs have accompanied market and economic meltdowns.

Stock investors are already nervous the higher yields could bring an end to the tech-led bull run. The spillover in stocks was already apparent Friday as the S&P 500 fell 1.5%.

Stay safe and make today great!!!