Good Friday AM from your Hometown Lender,

We had a blowout jobs report today and everyone in most all asset classes are licking their wounds.

Bond yields popped to highs not seen in more than a year (and that is after 100bps in cuts from the Fed), the 10yr yield is at 4.76%, mortgage bonds are off 35bps, Nasdaq is off 400pts, S&P down 100 and the Dow is down 700. Even Bitcoin is taking it on the chin.

Here are some interesting pieces from around the news feeds.

Rate sheets today will be worse, with rates moving up as much as a quarter point if these losses in bonds continue. Reprice risk on the day is high, mortgage bonds are selling off and the 10yr Treasury yield has spiked after the BLS jobs data came in crushing estimates.

This morning’s jobs data came in showing a seasonally adjusted (that means made up) 256,000 new jobs created last month, about 100k higher than the 155,000 that was forecast. Unemployment dropped to 4.1% from 4.2%, making it a double whammy for mortgage rates, and hourly earnings were up 0.3% from November as well. The reaction in the bond market was swift and brutal.

This morning’s jobs data has crushed Wall Street’s forecast for Fed rate cuts this year, pushing the expectations of a cut all the way out to June. The writing is on the wall that we will see higher mortgage rates as this year progresses.

How important are rate cuts to the bull case on equities?

It’s a pressing question for investors in risky assets, who’ve lately struggled to ignore the bond market’s agitated reaction to inflation risk.

Key evidence comes in the form of the December US employment report. Economists had predicted that non-farm payrolls increased by 165,000, based on the median forecast, with the unemployment rate steady at 4.2%. Bloomberg Economics had put the number of new jobs a lot higher — at 268,000 — while Nomura Securities cited indicators including hiring surveys and jobless claims in pegging it at 180,000. In short, the blowout jobs data wasn’t inconceivable, the kind of report that might lead Fed Chair Jerome Powell to put a fork in hopes he will keep lowering rates in 2025. Here is how investors might react to such a print would say a lot about what the future holds for risk assets.

It’s been a long time since better-than-expected employment numbers touched off a decline in equity prices, testament to how confident traders became that inflation had been licked. The last time was June, when a since-revised 92,000-jobs beat in payrolls rattled investors looking for a tamer print. Even then, the drop in the S&P 500 was a scant 0.1%

Since then the stock market has behaved pretty much how you’d expect it to when growth was the obsession of choice, going up when data was good. According to Peter Cecchini, director of research at Axonic Capital, there’s reason to believe that’s changing.

It’s a different story in the bond market, where yields on the 10-year Treasury have surged more than a full percentage point since the Fed began cutting rates in September, reaching 4.72% this week amid concern of resurgent inflation. Given the speed of that rise, strong data will hurt the market less than weak data will help it, some investors and strategists say.

Stocks, though, have rallied even as yields have jumped. Anything above 200,000 new jobs and the S&P 500 Index is seen dropping about 1%, according to Goldman Sachs. A JPMorgan Chase trading desk note sees the gauge poised to fall 0.5% to 1% if the print is above 220,000.

“As we continue to creep towards 5% on the 10-year yield, the reflexive reaction for equities on any strong growth/employment data prints becomes increasingly negative, especially given how stretched valuations have been,” said Cecchini. “Equities are pricing in near perfection,” but “’inflation has been far stickier than the Fed admits.”

Good news has been good news for a while now. The possibility of it becoming bad news again for stock investors is going up.

Stocks Embraced Higher Yields. Now They Fear Them.

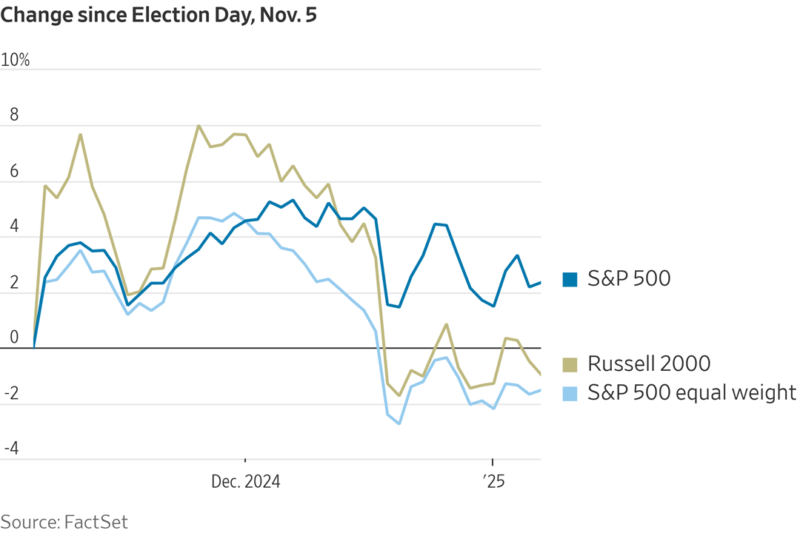

The 10-year bond yield came within a whisker of its high from last April on Wednesday morning, and stocks, especially smaller stocks, didn’t like it one bit.

It is part of a switcheroo by investors over the past month.

They have shifted from thinking that higher Treasury yields are just an unwelcome side effect of the stronger growth promised by President-elect Donald Trump, to worrying that higher borrowing costs might end up being very important. If the concern is right, get ready for a bumpy ride in 2025.

If yields keep rising, stocks could have a big drop, as they did when yields jumped toward 5% in October 2023. Investors who, like me, worry about high valuations and investors crowded into hot stocks might want to buy bonds now.

Investors who stick to stocks should have their fingers crossed that yields ease off again.

Stay safe, enjoy the weekend and first, make today great!!!