Good Friday AM from your Hometown lender,

WOW, I don’t know what else to say.

The market is all over the place. Equities are getting crushed again down another 4%. The 10yr note is back below 4% which is fantastic, but mortgage bonds and rates are not seeing as much improvement and are much more volatile than their big brother. Mortgage rates have dropped and will continue to drop but not at the same pace as Treasuries. In just three days, the 10y Treasury yield has dropped 35bps. Mortgage rates have improved about half of that. Part of this reason is that the Mortgage rate market is sensitive extreme volatility and how that impacts a pipeline of locks and renegotiation. Reprice risk on the day is moderate, right now markets are still panicking with no relief in sight, but crazy times can cause crazy swings. The initial reactions have been so dramatic that you have to expect some sort of a rebound. This is going to play out over days and not minutes, and unless there is a reversal in President Trump’s stance, we are likely to see bonds continue to rally and rates move lower.

The jobs data came in mixed, with payrolls beating forecasts. Revisions to last month’s report helped soften the blow and the unemployment ticked up as the participation rate moved higher.

Fed Chair Jerome Powell was in the news today speaking about how inflationary tariffs are going to be. Today’s jobs report gave the Fed a lifeline to not have to cut rates yet but when the employment situation worsens, the Fed will have to cut even if inflation has pushed up. Markets are now pricing in 4 cuts for this year with the first one possibly in May.

If you want a deeper dive on how the tariffs will impact all of us, the MBA shares a detailed piece…

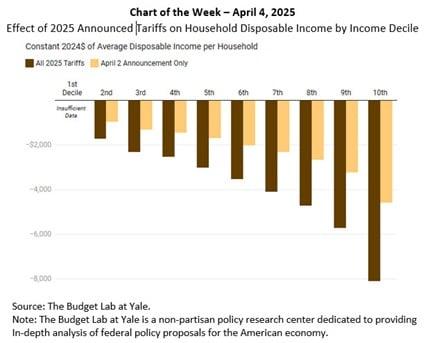

Current Chart of the Week

Since World War II, the consensus among economists has been pro-free trade with the attitude to tariffs summed up by JP Morgan’s David Kelly:

“The trouble with tariffs, to be succinct, is that they raise prices, slow economic growth, cut profits, increase unemployment, worsen inequality, diminish productivity, and increase global tensions. Other than that, they’re fine.”

On April 2, while there were no updates on earlier tariffs levied on Mexican and Canadian imports, the announcements brought total tariffs on China to 54%, the EU to 20%, Japan to 24%, and India to 26%. Wednesday’s announcements would put the total U.S. average effective tariff rate at 22.5%, roughly ten times as high as before 2025. We expect this increase in tariffs will result in slower economic growth and higher inflation, both headwinds for the housing market.

From our industry’s perspective, it is instructive to ask what tariffs could mean for borrowers’ disposable income and how they could affect debt-to-income ratios.

This week’s chart highlights The Budget Lab at Yale’s estimates of the effects of the April 2 announcements and all 2025 tariffs. While there is profound uncertainty concerning how long these tariffs will be in place and how our trading partners will react, it is a useful benchmark for analysis.

On average, the April 2 tariffs, together with all previously announced 2025 tariffs, would raise consumer prices in the short run by 2.3%, equivalent to an average loss of purchasing power of $3,800 per household in 2024 dollars. However, tariffs act as a regressive tax and the percentage change in disposable income is 2.5 times as much for households in the second decile (-4.0%) as those in the top decile (-1.6%).

To illustrate, suppose a typical household with an income of $80,000 has a $2,000 monthly housing payment (i.e., a 30% payment-to-income ratio). The disposable income for this median 5th decile household drops by $3,011, or $251 per month. In other words, in the short run, the household would have its after-housing (but pre-tax) monthly disposable income drop from $4,667 to $4,416 – equivalent to a 5.4% decrease.

Current homeowners may be insulated from the full effects of tariff price increases described above as principal and interest payments on a fixed-rate mortgage do not change as prices increase. However, tariffs may act to further erode housing affordability. This will happen through potentially fewer interest rate cuts to the Fed Funds Rate but also through increased building costs for new homes. For example, the National Association of Home Builders estimates an average cost increase of $9,200 per home due to tariff actions before April 2.

It is important to note that offsetting these negative impacts, at least for a time, is the sizeable drop in rates, with the 10-year Treasury dropping below 4 percent and almost 30 basis points lower since markets opened on April 2, back to its lowest level since last October.

Stay safe, enjoy the weekend, and make today great!