Good Thursday, AM from your Hometown Lender,

So much to mention today. First, I guess, is the economic data: Job cuts rose by 60% (yes, 60%), much of it attributable to the reduction in the Federal Workforce. Regardless of where the cuts are coming from, it will drive unemployment higher and will be a buffer against higher inflation. Unemployment claims, though for last week were flat and about in line.

Next, and before we get into the real news, If you want cheap eggs, how about your own chicken..

11 Million.

The number of households with backyard chickens in 2024, up from 5.8 million in 2018, according to the American Pet Products Association. Even U.S. Agriculture Secretary Brooke Rollins recently jumped in, saying she wants to help Americans save money by making it easier to raise their own egg-laying hens. Aspiring chicken-fanciers face plenty of hurdles.

Ok, the news on the day.

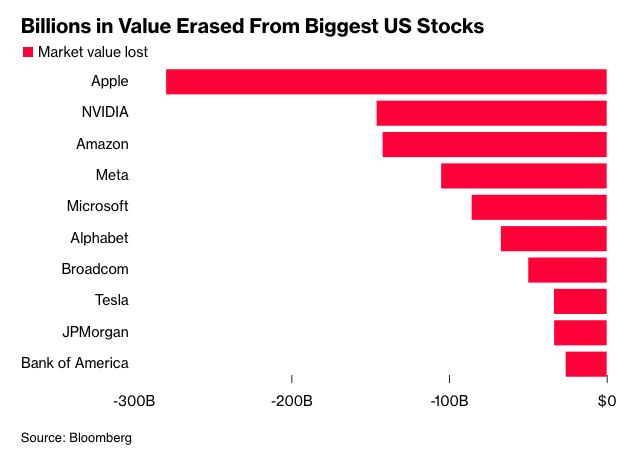

Roughly $1.7 trillion was erased from the S&P 500 at the start of US trading on Thursday amid worries that President Donald Trump’s sweeping new round of tariffs could plunge the economy into a recession. The index is on the brink of a crucial technical inflection point that threatens a longer-term wipeout.

The damage was heaviest in companies whose supply chains are most dependent on overseas manufacturing. Apple, which makes the majority of its US-sold devices in China, plunged after the open – even after a yearslong effort to insulate itself from trade wars.

No matter what you or I believe or how you or I feel about President Trump and the tariff plan, it’s here. And it is having a huge effect on the markets, which includes bonds and mortgage backed securities… which means it is affecting mortgage rates. So, let’s go ahead and stick to the script here, and talk about how all this may or may not play out for mortgage rates,

First off, a recap of yesterday’s events.

The expectation (which was wrong) was that bonds would be stable yesterday heading into President Trump’s press conference. Mortgage bonds lost about -20bps from morning rate sheets, opening the door for many reprices worse. The oversimplified reason was that traders were getting more optimistic that the tariffs weren’t going to be as bad as originally speculated. Really, it was all just rumor-mill stuff, but it was enough for stocks to rally and bonds to lose ground. As the press conference started, that sentiment grew, with the market breathing a sigh of relief that saw stocks rally and bonds lose more ground. However, that quickly changed as Trump rolled out the actual tariff plan on a poster board. Stocks and bonds whipsawed for the next hour, ending the day with more volatility that saw bonds slightly worse than when the market opened.

Today, though, rates are better as bonds continue to rally strong based on markets’ uncertainty on how all of this will play out. Despite the argument that tariffs will be inflationary and inflation is bad for bonds (which is normally true), that has all been pushed to the back burner for a couple of reasons.

The first reason is that inflation would likely hit hard for a couple of months but would then settle.

Continued inflation is a continued increase in prices. With these tariffs, it is more likely that prices would jump, causing a lot of immediate inflation, but wouldn’t continue rising unless the tariffs were moved higher.

The second reason is that markets loathe uncertainty and just don’t know what this trade war (a much more fitting term now than it was a couple of weeks ago) will do to the economy. As the economy weakens, it will weaken the labor market as well, and that benefits bonds. Also, we’ve seen a return to the old relationship between stocks and bonds, that when stocks lose ground traders move to safe havens in bonds… so bond yields drop and rates improve. Expect more volatility. However, in this volatility, we could see bonds sustain a rally that could help rate sheets match September’s levels. This is not guaranteed… it is just one way that things could play out, and right now based on the current reaction in markets, is a good bet. .

Tomorrow brings the jobs data, which is usually the big event for the week and even the month.

It will still be the basis for volatility. The expected number is currently 130k new jobs created last month. If the print comes in weaker, it will probably send traders spiraling lower and will see bonds rally stronger. However, if it comes in strong or at expectations, it likely will cap the gains at least for a little bit, and if the print is much stronger, I would look for a pullback.

A thing to keep in mind is that the outsized move in improved rates is currently unconfirmed. It could be and I would not be surprised if it is a knee jerk reaction. We do need to close below 4.04% to confirm the move is legitimate. Also, I do not like floating into a big news event like the jobs report.

Stay safe and make today great!!