Good Thursday AM from your Hometown Lender,

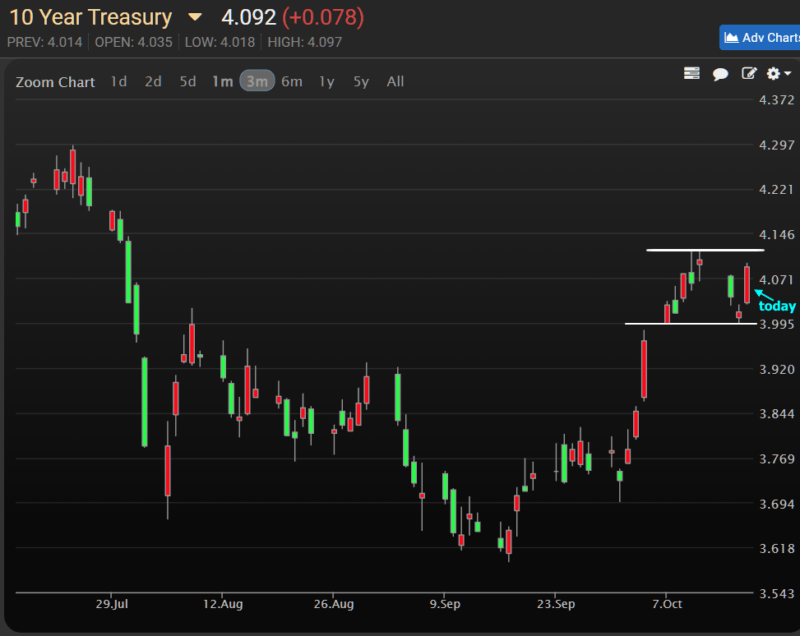

Ever since last Thursday’s econ data failed to cause a stir in financial markets, we knew we’d be waiting until today for big, data-driven volatility potential. Volatility goes both ways depending on the tone of the data. Unfortunately for bonds, all three of this morning’s economic reports were stronger than expected. The resulting move in bonds has been logical and unpleasant with yields quickly moving back toward last week’s highs. Perhaps it’s some small victory that yields remain several bps below those highs, or simply an indication that this is only bush league data compared to the jobs report. For the record, today’s data showed: Retail Sales strong at 0.4 vs 0.3. Ex Autos was a whopper at 0.5 vs 0.1

Weekly Jobless Claims

241K vs 260K but there were higher revisions to last week, and Philly Fed MFG at 10.3 vs 3.0. There was some lower tier data was weak but this the damage is already done. Like Sisyphus, we now get to push the stone to the top of the mountain yet again.

This was an interesting observation…

The standard 20% down payment on a median-priced home now costs 83% of a year’s income for the typical family ready to buy a home—that’s up from 65% on the eve of the 2016 election.

But even more than that is just regular consumer debt. American households are now sitting on a record $17.8 trillion in debt, $1.14 trillion of which is on credit cards, which tend to have relatively high interest rates.

Stay safe and make today great!