Good Morning on this fantastic Wednesday and best day of the week from your Hometown Lender,

Two important data points released today.

Both were very weak. The Job Openings report (JOLTS) which tells us just that, how many jobs are available across the country dropped off a cliff to 7.673 mm openings. Last month we were at 8.18mm. Factory Orders also came in very weak at 5.0% vs expectations of 8.1%. Bonds cheered the news. The 10-yr note is back down to 3.79% and mortgage bonds are up a dozen bps. The best part of the news though is the yield curve is un-inverting. The famed Ted spread (the 2-yr treasury yield vs the 10-yr treasure yield) went negative about 2 years ago and that is a common recession signal. While that is true, recessions don’t hit until after that spread un-inverts, which it did today. We are hovering around parity right now, but I see this as a very positive sign and a path (although it will be bumpy) back to normalization. It is tough to lock on a day like today but if you don’t lock today, you have to consider it tomorrow as it is not normally a good idea to float into a major news event, which Friday’s Jobs data is.

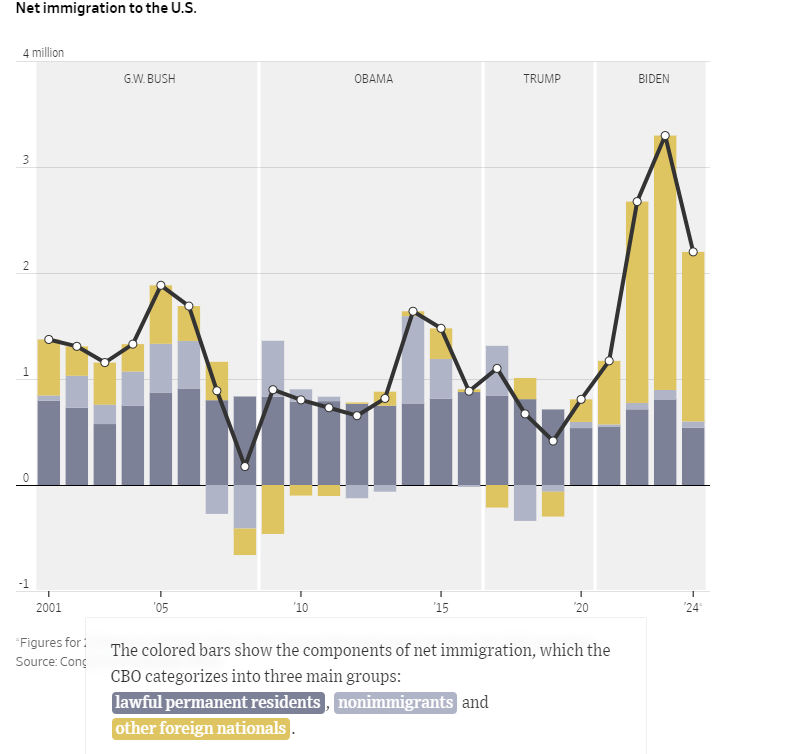

There was a great article in the WSJ on immigration that I thought I would share.

Take a look at the Gold Bars below…

The U.S. is experiencing its largest immigration wave in generations, driven by millions of people from around the world seeking personal safety and economic opportunity. Immigrants are swelling the population and changing the makeup of the U.S. labor force in ways that are likely to reverberate through the economy for decades.

Since the end of 2020, more than nine million people have migrated to the U.S., after subtracting those who have left, coming both legally and illegally, according to estimates and projections from the Congressional Budget Office. That’s nearly as many as the number that came in the previous decade. Immigration has lifted U.S. population growth to almost 1.2% a year, the highest since the early 1990s. Without it, the U.S. population would be growing 0.2% a year because of declining birthrates and would begin shrinking around 2040, the CBO projects.

Source: Congressional Budget Office

Did you know?

In 2022, the total count of second homes was 6.5 million representing 4.6% of the total housing stock, according to NAHB estimates. This reflects a decline from 2020, when the number of second homes stood at 7.15 million.

Stay safe and make today great!