Good Monday AM from your Hometown Lender,

Not a big week for economic news.

We have the minutes of the last Fed meeting Wednesday, the usual unemployment claims on Thursday, and then Chairman Powell’s speech from Jackson Hole on Friday. That last event will be the most important as Mr. Powell will have an opportunity to set the stage for a September rate cut (and how much the Fed will cut).

Two weeks ago, markets were betting on an emergency rate cut of 50bps and had an almost 100% expectation of another 50bps in September. Since then, no emergency cut, and the odds now show a 70% chance of a 25bps cut in September. How quickly things change and if you are questioning why rates have moved up a tad, this is the reason: this morning the 10-yr note is back to 3.85% and mortgage bonds are doing a little better (somewhat calibrated to the DNC convention which starts today). The expectation is a Harris win will cause less inflation than a Trump win and rates will be lower. I do agree that is likely but there are also benefits to having higher tariffs, lower tax rates and a secure border. In truth, from every analysis I have read, the delta between a Republican or a Democrat in the White house is 2% in GDP over four years. The economy can handle it either way.

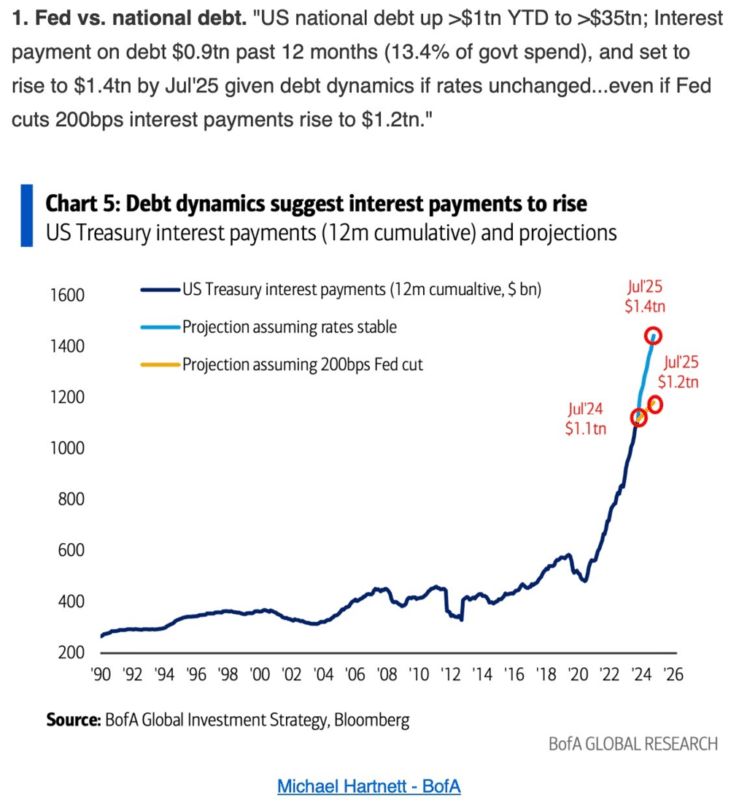

What the economy is not able to handle is the amount of government debt that is outstanding.

The interest (interest) payments on the national debt represent 13+% of all government spending and will top $1.4 Trillion yearly by mid-2025. The US deficit in 2024 is $1.6 Trillion. We are borrowing more to pay for our borrowing. If rates were lower, the interest payment would be lower and so would the deficit. This alone is a reason for the Fed to cut aggressively. All of GDP (what we produce as a nation) is $20 Trillion/year and the total amount of US Treasury debt (bonds) outstanding is $27 Trillion.

WHAT?

Stay safe and make today great!