Good Tuesday Morning from your Hometown Lender,

On no news, the bond market seems to be improving.

The 10yr is back to 4.37% and mortgage bonds are +16bps. Pretty much the reverse of yesterday. Markets are not sure which way to bet on tomorrow’s CPI data. Regardless which way the data comes in, stronger or weaker, markets will have an outsized reaction. CPI is expected to come in at .3% better than last month’s .4%. seems like a reasonable number. What I am curious about is how much the run up in oil prices will impact the report. Oil and gas prices have jumped, and I could see that pushing CPI up quite a bit. Once we navigate through tomorrow’s report, we then have the PPI report on Thursday. In between those two reports, we have an important 10yr Treasury auction, and we see the minutes of the last Fed meeting. Busy next few days for sure. The challenge though is even with a low inflation report (fingers crossed), how much will it impact the Fed. I don’t think much.

Two quick hits from the WSJ:

The country added far more jobs than economists anticipated in March, the latest data point suggesting that economic growth is still chugging along. While that’s good news on its face, the data fueled doubts that U.S. inflation is cooling as investors have hoped. Investor expectations for interest-rate cuts in 2024 are starting to shift, which we’ll cover in more detail below. That might make March’s reading of the consumer price index, due Wednesday, even more important than usual. Economists have forecast that prices rose 0.3% from February, which would equate to a 3.5% rise over the prior twelve months.

Doubts Creep in About a Rate Cut this Year

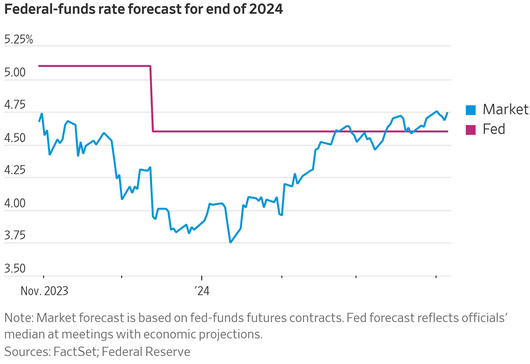

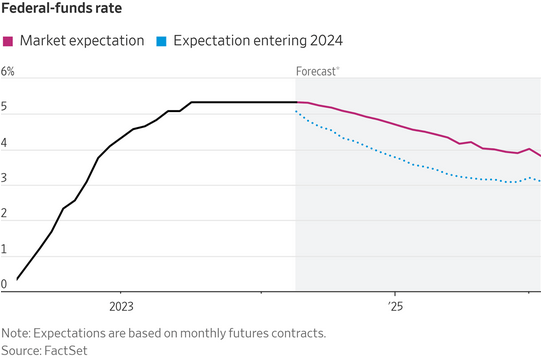

More traders are betting the Fed may cut the benchmark federal-funds rate just once or twice this year. (Thanks, jobs report.) And a handful are even starting to wager that the central bank will leave rates where they are, reports Eric Wallerstein. Just last month, Fed officials said they still saw three rate cuts this year. The shift could pose a challenge to a stock-market rally built on the hope that the economy would slow enough for the Fed to lower borrowing costs, but not enough to start a recession.

Please remain safe and healthy, make today great!