Good Monday Morning from your Hometown Lender,

We can’t get a break, yet.

No data today but the bond market is all a flutter over recent Fed comments that span from, maybe three cuts is too many this year, to we may not cut at all, to maybe we need to raise rates higher to curtail inflation. Markets are certainly trading the rumors right now. This is an important week as we have both CPI on Wednesday and PPI on Friday. Those inflation metrics will move markets, that I am confident in. I am hopeful that we come in below expectations of .3% and of so, bonds will get a bid and rates improve. If not well, even with today’s selloff and the 10yr back to 4.44%, there is room for it to get worse. If you are floating, it will be Wednesday at the soonest before you can potentially see some improvement.

The WSJ shared much of the same with:

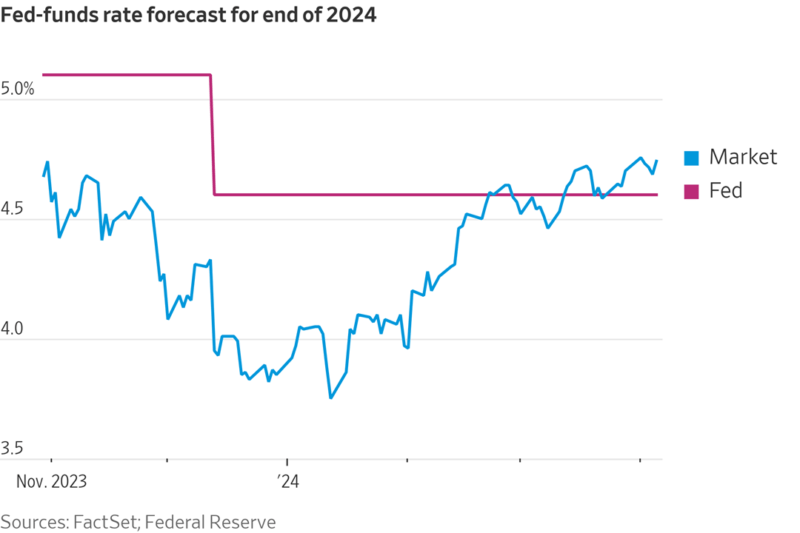

After the latest blockbuster jobs report Friday showed continuing strength in the economy, more traders are betting the Fed may cut the benchmark federal-funds rate just once or twice this year, fewer than officials’ last median forecast of three quarter-point cuts.

And a handful are even starting to wager that the central bank will leave rates where they are.

The shift could pose a challenge to a stock-market rally built on the hope that the economy would slow enough for the Fed to lower borrowing costs from multidecade highs above 5%, but not enough to start a recession.

Stay safe, and make today great!!!