Good Morning on this Friday from your Hometown Lender,

Here we go again:

The March US payrolls data is out and blew by expectations…again. Markets were looking for 214k new jobs and we got 303k (some negative revisions to previous months as well). The unemployment rate ticked own to 3.8% from 3.9% which was expected, and hourly earnings were in line at .3%, 4.1% for the year. According to the report, hiring has continued to be stronger than expected and some economists say that undercounts of new immigrants are driving the trend. With this additional sign of robust economic activity bonds are selling off a bit leading to bets that the Fed will keep rates higher for longer. I think June is still a long enough way away that we could see a June rate cut, but the waters continue to get murkier.

Lots of Fedspeak this week.

Neel Kashkari, president of the Federal Reserve Bank of Minneapolis who previously was the most outspoken dove and has in the last year, become the biggest hawk on the Fed, floated the idea that the Fed may not cut at all this year. Austan Goolsbee, the President of the Federal Reserve Bank of Chicago shared the largest impediment to the U.S. central bank’s efforts to return inflation to its 2% target rate is the persistence of outsized price increases in the housing services sector. He added that based on market data on rents for new leases, “I have been expecting it to come down more quickly than it has. If it does not come down, we will have a very difficult time getting overall inflation back to the 2% target.” The Fed is in a catch 22 they created. Higher rates causing less supply causing higher prices. The only way out is more supply (or I guess, less people).

Interesting perspective:

Compared to the 2006 Housing Boom peak, home prices are currently 71% higher. However, after accounting for inflation, home prices are just 10% higher. Thought of slightly differently, nominal home prices are exactly double what they were in 2004. That works out to a compound annual growth rate of 3.6%. While housing prices went crazy during Covid, over the long run price increases have been rather pedestrian.

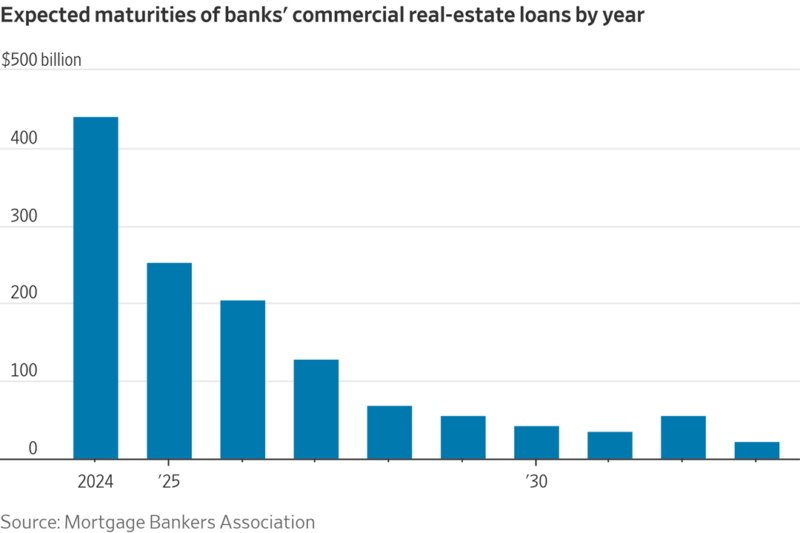

And how have higher rates impacted commercial real estate?

The phenomenon known as “extend and pretend” has added significantly to the mountain of bank maturities related to commercial real estate this year. More then $400B in commercial loans coming due this year.

Stay safe, enjoy the weekend, and make today great!