Good Morning on this Thursday Afternoon from your Hometown Lender,

Bonds started off in trouble yesterday on some stronger than expected ADP payroll report.

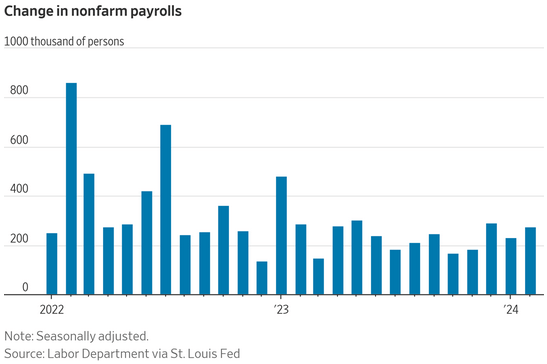

Mid morning though, Federal Reserve Chair Jerome Powell said that the recent, hotter readings on price-growth don’t “materially change” the overall view and that it will likely be appropriate to start cutting later in the year. Markets cheered that and bonds turned around to close almost unchanged on the day. Fed Governor Adriana Kugler echoed the sentiment, setting the stage for a parade of Fed speakers this week — five more policymakers spoke today with everyone saying inflation is still a concern and the Fed needs more information before cutting rates. Gold extended and hit yet another record, copper prices are at the highest in more than a year and the risk-on sentiment is on display in Europe. The dollar steadied following its biggest drop in four weeks. Unemployment claims out this morning came in higher than expected helping to boost bonds a bit more. The highlight of the week though is tomorrow’s March payrolls report from the Labor Department. If economists polled by the Wall Street Journal are on the mark, the data won’t complicate the Federal Reserve’s outlook: they’re expecting 214,000 jobs were added in the month, which would mark a slight decline from February’s initial reading. And they’re projecting a slight drop in the unemployment rate to 3.8%. If you are going to float, know that tomorrow’s volatility is going to be high.

There was an interesting piece in the WSJ on a topic I wonder about.

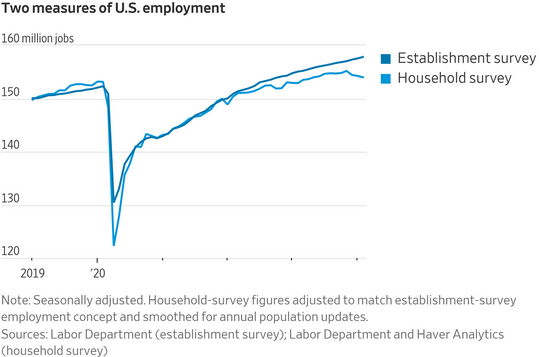

How is US Employment picture so strong.. Great answer below, immigration.

Rising immigration is the emerging consensus. If the new school of thought is correct, it not only explains inconsistencies in the jobs data but suggests the economy can keep adding plenty of jobs without overheating. That in turn would let the Federal Reserve still consider interest-rate cuts.

Stay safe, make today great!