Good Morning on this Thursday AM, from your Hometown Lender,

Unemployment claims in a little lighter than expected.

GDP was a huge miss. Markets expected 2.5% and the print was 1.6%. It should have sent rates lower, much lower, but the opposite happened. Traders quickly dissected the data and saw that while the growth part of the report fell like a rock, the inflation components were higher than expected. Bond are off a bunch and the 10-yr yield is up to 4.71%.

Thus was a shocker.

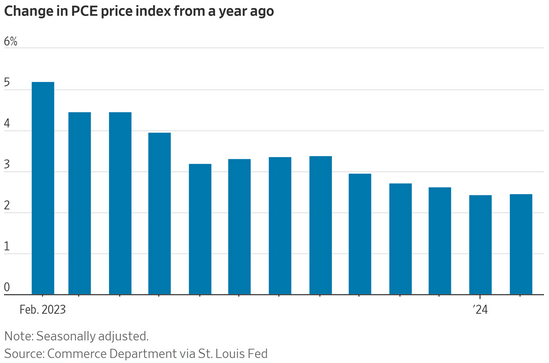

Tomorrow brings the PCE report which is the Fed’s favorite inflation gauge. Markets are expecting a .3% print. If the print comes in at .3% or below, we should see rates improve. If higher than .3%, it will get uglier. That .3% estimate is still above the Fed’s long-run target of 2%. But it’s also far below the consumer price index, which showed prices rose by 3.5% over that same period. One key difference between the two indexes: In the CPI, shelter costs for homeowners and renters account for about a third of the index. They comprise only about 15% of the PCE.

Needless to say, tomorrow is a big day for data and the last big report the Fed will see before their meeting next week.

Stay safe, make today great!