Good Tuesday AM, from your Hometown Lender,

A little bit of data out this morning.

New Home Sales beat expectations, which is good for equities, and the Richmond Fed Index was as expected at -7 (yes, negative 7). I think the latter speaks to the reality of a softer economy than what the data has been showing. We will have a 2-yr Treasury auction in about an hour. That will be key. The 2-yr yield as of this AM, is 4.99%. Let’s hope there is no tail pushing yields over 5%. Psychologically, that is a bad thing.

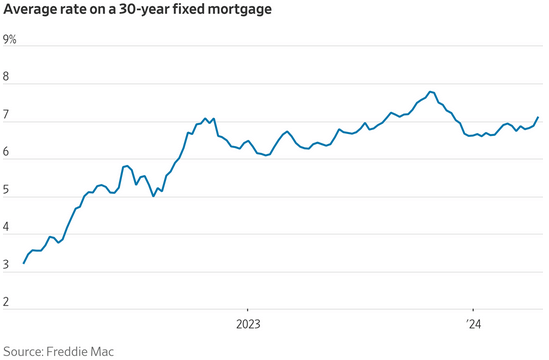

The weekly calendar heats up tomorrow with Durable Goods, Thursday is Unemployment claims and GDP. Friday brings PCE. These are all a lead up to next week’s Fed meeting. We are range bound for now, although any of these data points has the potential to put more pressure on bonds and rates. My gut is telling me we should float but my head is saying it is a good time to lock anything closing in the next 15 days. The flip side is a question I have been curious about. At what point do sellers capitulate and recognize that waiting for rates to return to pandemic lows is foolish? They are in effect causing their own affordability problem. Waiting to sell is pushing home prices up. A couple of snippets from the WSJ are below.

A 5% Treasury Yield Isn’t Out of the Question

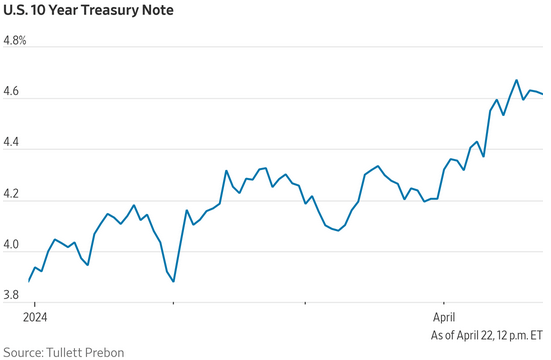

A recent jump in U.S. government-bond yields has left investors pondering whether the benchmark 10-year Treasury yield will keep rising all the way to 5%, a scenario that seemed remote just a few months ago. The rate settled Monday at 4.622%, up from 3.860% at the start of the year. Breaching that milestone would require rate-cut expectations to be scaled back even further. Investors expected as many as six cuts from the Fed at the start of the year, but many are now expecting none, analysts said.

Home Sellers Get Tired of Waiting For the Fed

Not everyone can wait out the toughest housing market in years, reports Veronica Dagher. In year three of the Fed’s high-rate policies, some home sellers and buyers are giving up waiting for the central bank to change course. “We can’t just let our kids grow up while the Fed figures out what they think about inflation,” said Luke Bolton, who listed his home in March and expects to close soon on a purchase.

Stay safe, make today great!