Good Tuesday Morning from your Hometown Lender,

I could just paste yesterday’s update as bonds are taking a beating yet again able it not as severely as yesterday. The primary culprit as I continue to read is that the potential for an escalating conflict in the Middle East. Will Israel retaliate? The theory used to be that war was a great boost to bonds as traders look to safer havens. I guess it just depends on where the conflict is. I understand that a war in Iran certainly impacts oil production and prices which will increase inflation although the US produces more oil than we consume. I must discount this theory. Maybe war and oil are contributory, but oil prices have not moved since Iran sent missiles and drones to attack Israel over the weekend and oil prices have not moved today despite concern over Israel’s response.

I think the first catalyst for higher rates is the data.

Strong inflation, strong employment, strong retail sales. Watching CNBC this am, there is talk about a 10yr note breaching 5%. The wheels come off the bus when that happens. I will reiterate that today, this more than anything else is an opportunity to buy. Rates are not yet improving to where buyers are flooding the market although demand still outweighs supply. When rates do make a real move lower, there will be a corresponding increase in price. Higher rates are less problematic for buyers than higher home prices.

According to CoreLogic’s tally, their share in the last quarter of 2023 reached a new high of nearly 29% — 28% in October, 27.3% in November, and 28.7% in December. That’s more than the former record of 28.3% in February 2022.

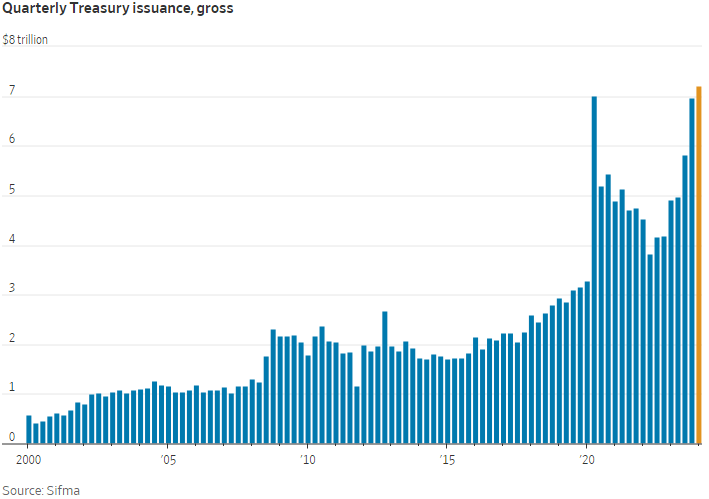

America’s Bonds Are Getting Harder to Sell (this is not good for rates):

A series of weak auctions for U.S. Treasurys are stoking investors’ concerns that markets will struggle to absorb an incoming rush of government debt. Investors’ lackluster demand for a $39 billion sale of 10-year Treasurys sparked a bond selloff last week. Behind buyers’ caution lies a growing conviction that inflation isn’t fully tamed and that the Fed will leave interest rates at multidecade highs for months, if not years, to come.

U.S. Economy Expected to Keep Powering Higher (also not good for rates):

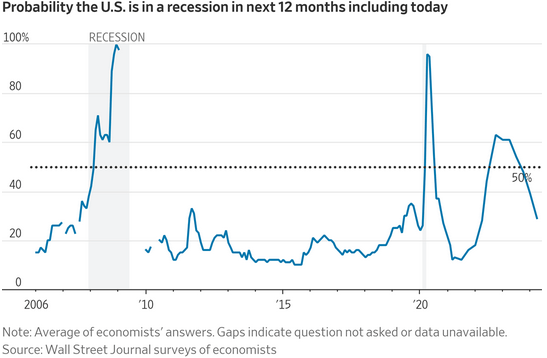

Forecasters have become increasingly optimistic about the U.S. economy. In the latest Wall Street Journal quarterly survey, business and academic economists lowered the likelihood of a recession to 29% from 39% in January’s poll. In January, economists forecast sub-1% growth in each of the first three quarters of this year. But the U.S. economy has far outperformed expectations over the past year and a half and that resilience has forced them to rethink their forecasts. Now, they expect growth to bottom out this year at an inflation-adjusted 1.4% in the third quarter.

Stay safe and make today great!