Good Thursday Morning from your Hometown Lender,

Well, yesterday was a tough day.

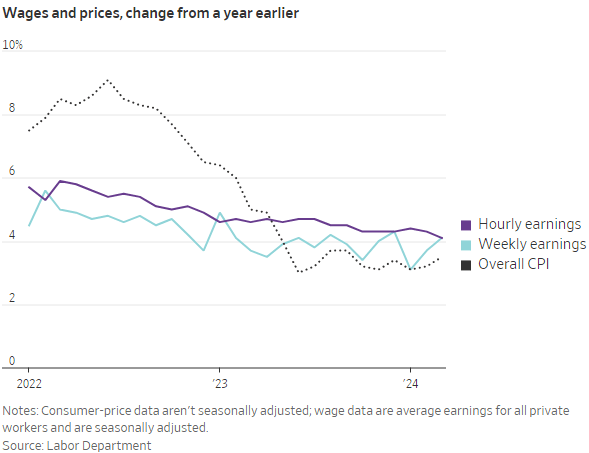

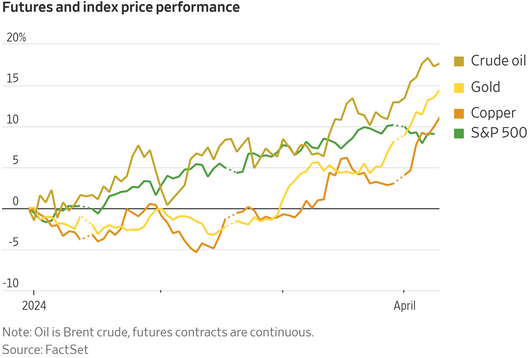

CPI missed expectations by an inch (less than .1%) and markets blew up. Selling begot more selling and so the day and night went until bonds settled about where we were over last Thanksgiving. Much (much) worse than where we were on Tuesday. Today’s PPI report came in weaker than estimates and by the same margin as yesterday’s CPI miss to the other side, but markets are not feeling any love or support by the encouraging report. PPI will filter into CPI in the coming months and the employment cost piece of CPI did moderate so I am still encouraged about the near-term future although a June rate cut does not seem likely. A fly in the ointment is going to be commodity prices which are rising quickly. That really only happens during expansive times. Maybe the economy is doing better than what we see. Several Fed members out today saying that they know inflation will moderate, it is not going to be a straight line down but that they may take a bit before cutting rates. The Fed meeting minutes released yesterday echoed much of the same and they did infer that QT, where the Fed sells off its bonds will slow down in the summer. Anyway, no joy in Mudville (anyone remember Casey at the Bat?) for the moment though there are lots of strategies on how to counterattack higher rates. Please let me know if you would like to discuss.

The WSJ had a few interesting pieces on inflation and commodities…

Inflation is Still Too Hot

The Fed’s next policy meeting just got a lot more interesting. How’s that? Well, the consumer price index disappointed for the third straight month. Consumer prices rose 0.4% in March from a month earlier, and 3.5% over the past year. Core prices, which strip out food and fuel costs, advanced 3.8%. Those figures were all higher than economist forecasts compiled by the Wall Street Journal. Fed officials last month generally expected the central bank to cut short-term interest rates three times by the end of this year. They had been willing to look past firmer inflation in the first two months of the year, as Nick Timiraos explained. But has Wednesday’s news changed things? Investors seem worried that may be the case; major stock indexes sold off and the 10-year Treasury yield rose to 4.559% from 4.365% on Tuesday, the largest one-day increase since September 2022.

Commodities Rally Reflects a Better Economy, Poses Fresh Risks

Here’s a potential complication to the inflation picture: A surge in prices for the raw materials like oil, copper and gold shows investors betting on a prolonged expansion. An index of global commodities prices, the S&P GSCI, has advanced 11% this year through Tuesday, outpacing the S&P 500’s 9.2% climb. The rally is rooted in expectations that economic growth will increase demand from the U.S. and China, and many expect the climb could continue for some time.

Please remain safe and healthy, make today great!