Good afternoon on this holiday week Monday from your hometown lender,

Bonds are off a bunch today and back to the worst of Thursday’s levels.

4.60 on the 10yr. Why? Well, that’s a tough question to answer as there is no real news. Durable goods orders are down. Consumer confidence is down. Maybe revisions to the Durable orders have something to do with it as those came in hot but I think it is more that this is the first day of a two-week hiatus/holiday many traders take. The lack of any real volume of trades makes moves more exaggerated. Markets close early tomorrow and are closed Wednesday. I don’t think we will or should see much movement from here.

If you are short on things to read, here is a good piece in the WSJ The Fed Cut Interest Rates. Mortgage Costs Went Up. – WSJ

The Fed Cut Rates. Mortgage Costs Went Up.

Surging Treasury yields have pushed borrowing costs higher

Interest rates Sources: Freddie Mac (mortgage rate); Federal Reserve (fed funds rate)

Hopes were high that the Federal Reserve could make homes more affordable by cutting interest rates. So far, mortgage rates are rising instead.

Average 30-year mortgages have climbed to around 6.7% from roughly 6.1% since the Fed started lowering rates in September, according to Freddie Mac. And they are only poised to rise further. That is because mortgage rates move with the yield on the 10-year Treasury, which has surged this week.

Here are six charts showing the forces aligned against potential home buyers at the moment.

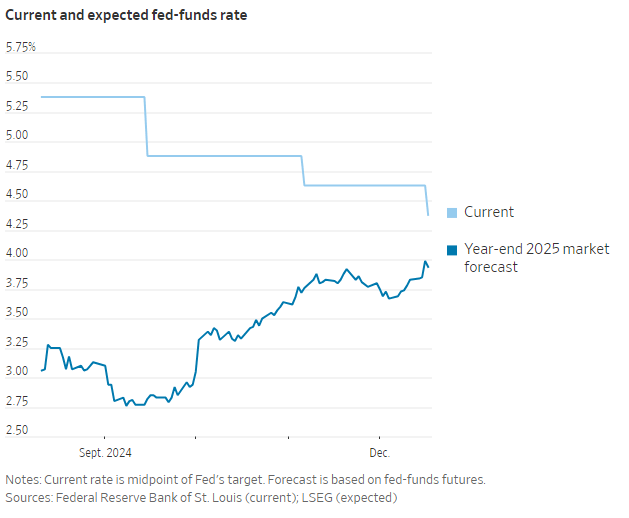

Rates fall. Rate expectations rise.

Mortgage rates are based on long-term Treasury yields. Those are mostly driven by expectations for where short-term interest rates will be in the future, rather than where they are now. And those expected rates have been going up, even as actual rates have been dropping.

Current and expected fed-funds rate Sources: Federal Reserve Bank of St. Louis (current); LSEG (expected)Notes: Current rate is midpoint of Fed’s target. Forecast is based on fed-funds futures.

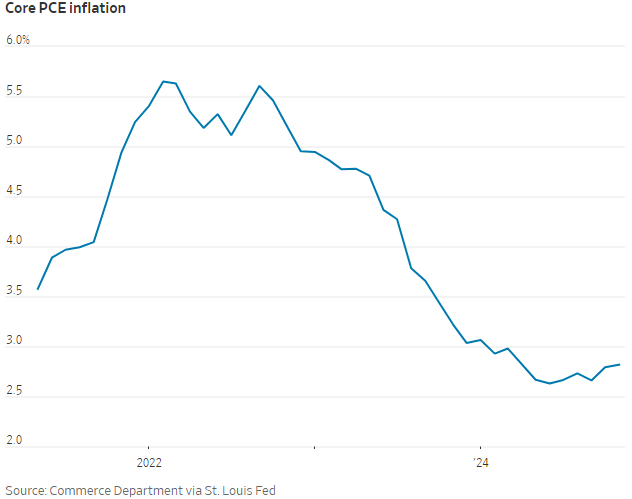

The ‘I’ word

A big reason why rate expectations have been rising is inflation: After falling steadily back toward the Fed’s 2% target, the pace of price increases has recently stalled out above that level.

Most analysts still expect inflation to fall a little further next year, but the recent trend has become hard to dismiss. Fed Chair Jerome Powell said on Wednesday that the central bank’s near-term inflation forecast had “fallen apart.”

Core PCE inflation Source: Commerce Department via St. Louis Fed

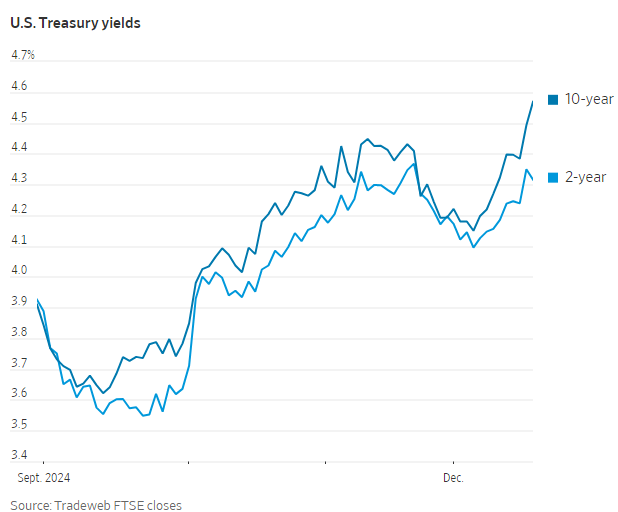

An added boost

Longer-term Treasury yields are set not just by investors’ calculations about where short-term rates will go over the next couple of years, but also by their broad assessment of the risks of holding on to bonds for an extended period.

Factors such as stubborn inflation, elevated budget deficits, and the prospect of tariffs and tax cuts in a second Trump administration have all helped turn investors against longer-term Treasurys in recent weeks. As a result, the 10-year yield has climbed more than the two-year yield.

U.S. Treasury yields Source: Tradeweb FTSE closes

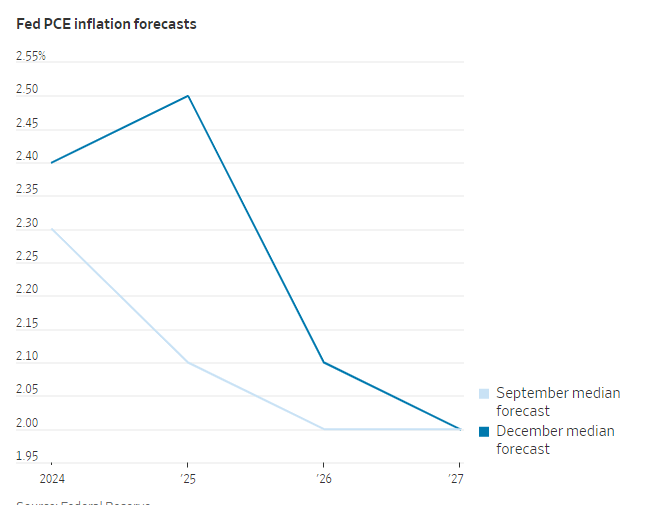

New fuel

The Fed on Wednesday added to those concerns by forecasting higher inflation over the next couple of years, with Powell saying that some officials had factored in potential policy changes into their projections.

Fed PCE inflation forecasts Source: Federal Reserve

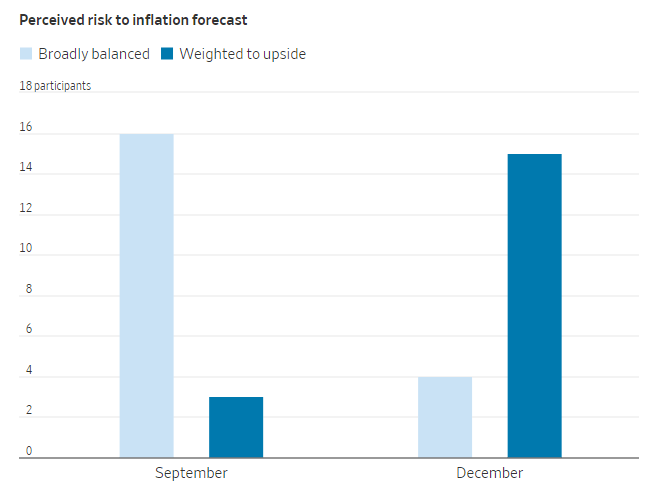

There was also a big jump in the number of officials who said that the risks to inflation are “weighted to the upside”—likelier to come in hotter than expected than cooler.

Perceived risk to inflation forecast Source: Federal Reserve

Staying put

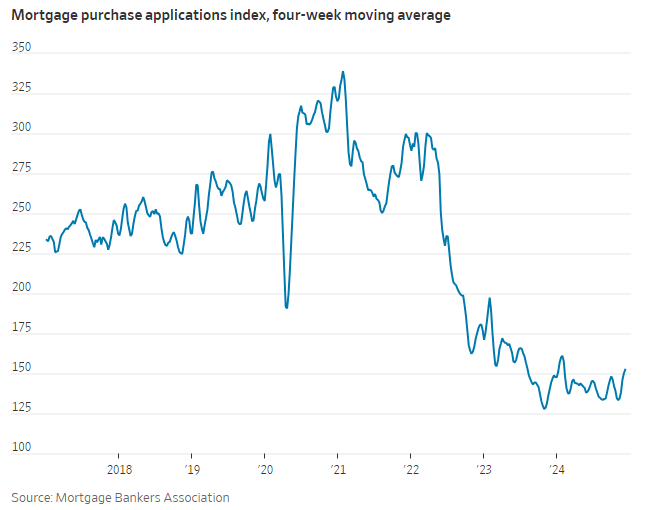

Meanwhile, high borrowing costs continue to dissuade people from buying homes. Mortgage applications to buy a home briefly ticked higher earlier this year. They have flatlined since.

Mortgage purchase applications index, four-week moving average Source: Mortgage Bankers Association

Happy Holidays, Stay safe and make today great!