Happy Monday AM from your Hometown Lender,

Friday had best pricing we’ve seen in a couple of weeks, but only time will tell if rates improve from there. This morning’s rate sheets will be a bit worse, as mortgage bonds give back some of Friday’s gains. There’s not any economic data to worry about ahead of Wednesday’s consumer price index (CPI) inflation data. Although surprisingly good inflation data this week showing that inflation is falling faster than expected could help rates improve further, without that help it is looking like we could see rates creep up from here.

Here are a couple of good articles. One from the WSJ and the second from Bloomberg

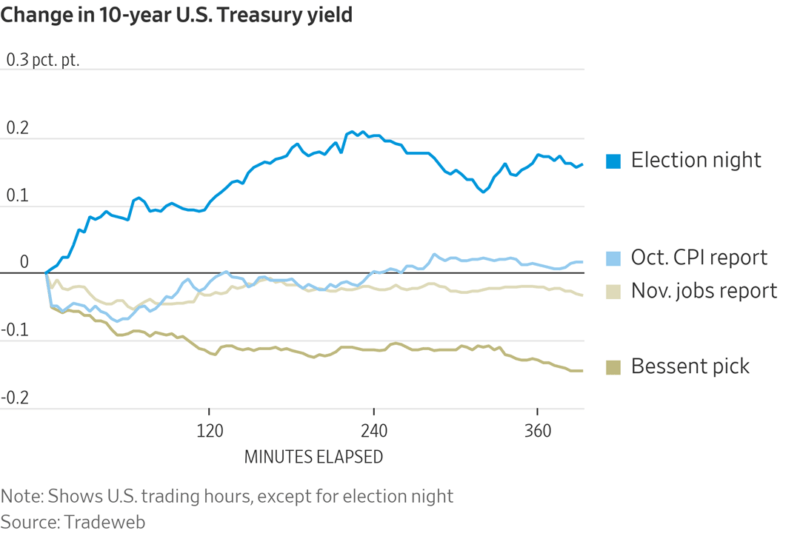

Treasury yields, a crucial driver of borrowing costs across the economy, typically fluctuate with traders’ bets on short-term interest rates set by the Federal Reserve. But their biggest moves lately have been sparked by election results and President-elect Donald Trump’s pick of Scott Bessent as Treasury secretary.

Will the Fed cut interest rates

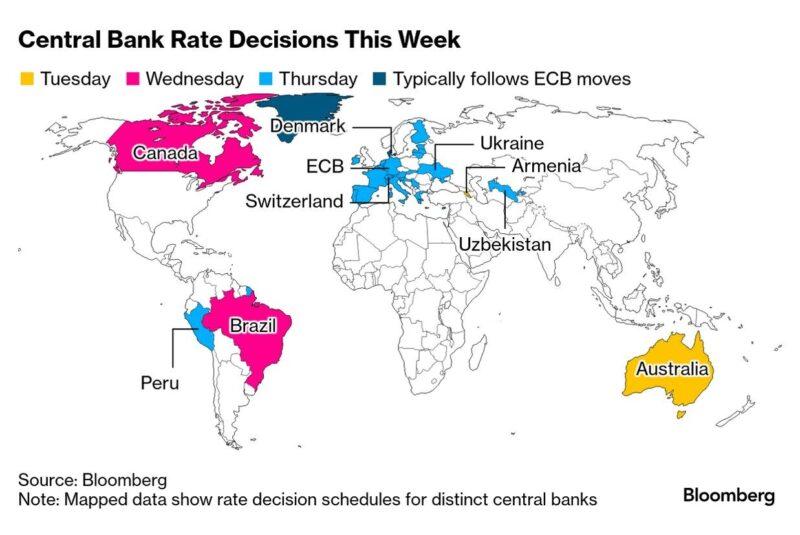

A run of hard-to-predict central bank decisions in the world’s biggest economies is coming up.

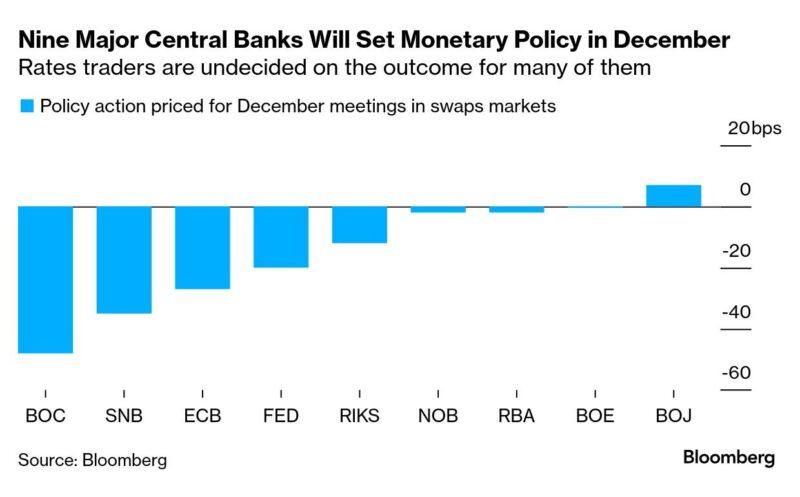

Nine Group-of-10 central banks will debate and decide monetary policy in the next two weeks. Markets haven’t fully made up their mind on the outcome for many of them. That means volatility at the end of a year in which most central banks took longer to cut interest rates than investors had forecast.

Traders aren’t fully pricing a quarter-point reduction from the Federal Reserve on Dec. 18. They’re also not completely confident the Bank of Japan will hike its benchmark on Dec. 19.

They have turned more confident the Bank of Canada will go for a jumbo half-point cut on Wednesday, but the likelihood the Swiss National Bank does the same on Thursday is on a knife-edge, according to swaps pricing.

As for the European Central Bank, which also convenes on Thursday, investors can’t quite shake the idea that it will deliver a bigger cut in coming months even though there is agreement this week will see a quarter-point reduction.

“Rising uncertainty over economic and trade policy has been hanging over global markets,” said Joe Little, global chief strategist at HSBC Asset Management.

There’s plenty of other potential curveballs. Donald Trump continues to threaten tariffs, government drama is roiling France, Germany and South Korea, while military conflict in Ukraine is escalating. Now, the collapse of the Assad regime in Syria risks intensifying Middle East tensions.

It’s a geopolitical free-for-all right now with a reckoning awaits between populist politics and the bond market. This macro backdrop is leading many investors to take risk off the table into year-end.

Stay safe and make today great!!!