Good Friday AM from your Hometown Lender,

A slower day in the markets, finally.

Consumer sentiment numbers did come in a bit hotter but that is the least of the volatility we have seen. The Fed cut .25 yesterday as expected and of course commented that each meeting is data dependent. The positive spin was Fed’s Chairman Powell said that the Fed has no prejudice towards what President Trump’s policies will be and they continue on a rate cut path. That does leave the door wide open for more cuts and I expect we will see another cut in December. Have we seen the top end of the yields, it feels like it for now… the 10yr note is sitting at 4.31% and is right at the line of resistance. If we can close below 4.30, we could see the 10yr improve to 4.16 or so. None the less, the dust has settled and rates sheets this morning are better than yesterday, and reprice risk (thankfully) on the day is low. After a week of volatility where every day has held not only the possibility but the probability of repricing, we can finally take a breath heading into the weekend. Not only that, we can feel good that after the jobs data, the elections, and the Fed meeting that rate sheets should be at the best levels we’ve seen since October.

The WSJ shared a recap of the Fed and mortgage rates which we all likely have a good idea about but it is still worth sharing.

Borrowers aren’t yet feeling the effect of the Federal Reserve’s interest-rate cuts.

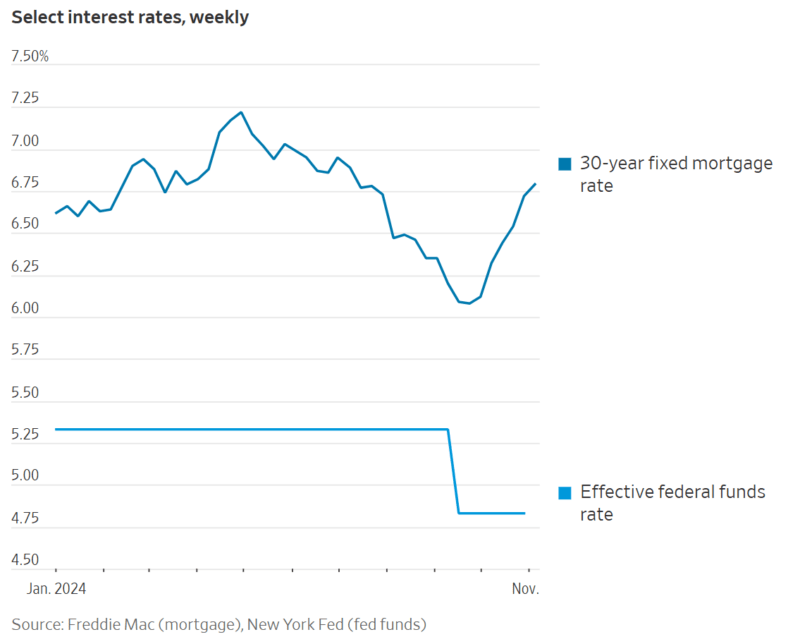

The central bank lowered its benchmark rate by a quarter-percentage point Thursday, following its half-point cut in September.

But the average rate on a 30-year fixed mortgage has gone in the opposite direction since the Fed’s first cut, rising by more than half a percentage point to 6.79% this week, Freddie Mac said Thursday. It might keep climbing, tracking the recent rise in the 10-year Treasury yield.

The Fed wants to push down the cost of borrowing money for homes, cars and other purchases. But mortgage rates aren’t determined by the Fed, they are heavily influenced by Treasury yields, which go up and down based on economic expectations. And the outlook for growth is strong, keeping both yields and mortgage rates high.

Yields have also been rising since President-elect Donald Trump’s victory. Investors think that Trump’s tax-cut heavy agenda would add to the deficit and increase economic growth and inflation. That would put upward pressure on Treasury yields. Trump has also promised higher tariffs, which could further add to inflation.

“Higher for longer, unfortunately, for all of us is going to be a thing, even in the face of Fed rate cuts,” said John Toohig, head of whole-loan trading at Raymond James. “You would need to see the economy show some real signs of economic weakness to see rates truly drop.”

Across the board, consumer borrowing rates haven’t tracked the Fed’s move lower.

Average credit-card interest rates, which typically lag behind Fed cuts by a couple months, dipped slightly to about 20% on Wednesday from 21% on Sept. 18, according to Bankrate. An average five-year loan for a new car had a rate of 7.6%, versus 7.7% in mid-September.

Still, consumers tend to look to the Fed as a guide. Nearly two-thirds of car shoppers, for example, said in an August survey that a Fed rate cut would affect the timing of a car purchase, according to car-shopping site Edmunds.

The interest rates banks pay customers on their accounts have also been slow to fall. The highest yielding one-year CD had an average rate of 4.6% in late October, versus 4.9% in mid-September, Bankrate said. The highest yielding savings account rate fell to 5.1% from 5.3% over that time.

The rise in mortgage rates has dampened any rebound in home sales and given owners less of a reason to refinance. Mortgage applications have fallen for six straight weeks, according to the Mortgage Bankers Association.

In the housing market, would-be buyers are having to make peace with high rates on top of high home prices.

Tristan Kaisharis has been looking with his wife for a house in the Dallas area. He said some homes he came across have nearly doubled in price over the past few years. The cost of buying a similarly sized home to where the newlyweds live now is far more expensive. They want to sell their current house but worry about finding buyers at current mortgage rates.

He says mortgage rates would need to be closer to 5% for them to feel comfortable buying.

“The rates are not where we need them to be to account for how high home prices have gotten,” he said.

Stay safe, enjoy the weekend, and first make today great!