Good Tuesday AM from your Hometown Lender,

And the hits keep on coming (unless you’re a Yankee fan as the team is a game away of being swept because of a lack of hitting).

For our purposes, the hits are the higher yields in the treasury and mortgage markets. Bonds are off again today which feels like the 100th day in a row we’ve lost ground (really only the 40th ☹). The 10-yr yield is up 70bps from where we were before the last Fed rate cut.

What do you think markets are expecting for the future?

Clearly fewer fed cuts and higher inflation… Today’s data was more bond friendly than not. Consumer confidence jumped a bunch (I suspect due to election outcome expectations) but the JOLTS report, which is a snapshot of available jobs, tanked. Employment picture at least today is not rosy. The Fed is certainly aware. This should have helped bonds but not much will now with markets betting on the election.

On that note, I’ve included a few interesting pieces below.

Economists have been warning that recent hurricanes and the strike at Boeing could make the October jobs report on Friday hard to interpret. The unemployment rate should be less affected than the job-creation number will be, Citi economists write. That is because in the household survey–which determines the unemployment rate–people who missed work because of weather and strikes still count as employed, Citi writes. A rise in unemployment above 4.2% would be a sign that September’s strong report was more of an outlier, while a reading below 4.1% would be a clearer signal of a soft landing, Citi says. Citi sees a 4.2% unemployment rate versus the 4.1% that The Wall Street Journal’s survey gives as consensus.

The prospect of a rising federal budget deficit is fueling a sharp climb in bond yields, with investors betting a challenging fiscal situation might only get worse after the election. Treasury yields, which rise when bond prices fall, jumped Monday after a $69 billion government auction of 2-year notes attracted tepid demand from investors. Most investors expect the budget deficit to remain elevated no matter who wins in next week’s elections, with the cost of spending programs such as Medicare and Social Security climbing faster than federal revenues. Still, many think the budget gap will expand the most if Republicans sweep control of both the White House and Congress, leading to extensions of old tax cuts and the possible addition of new ones.

Election countdown

A week before the US election, Wall Street is falling over itself trying to suss out what the next president means for markets. Investment playbooks are being dusted off, gaming out everything from a gridlocked Congress to the impact of tariffs on inflation, and more.

Here are some of the latest takes:

While investors are worried about being left behind should stocks and bonds stage big moves after the vote, just as much danger exists in taking previous trading patterns too seriously. In one example, Deutsche Bank issued a warning Monday to those expecting another Donald Trump-fueled stock rally, saying the ex-president’s current lead on internet-betting sites may prevent a repeat of the come-from-behind shock that catapulted assets in his first term.

A loose consensus has formed among investors.

A survey by market-research firm 22V looked at just the first week following the vote, and found investors expect large-capitalization stocks to win under every scenario except a Republican sweep, in which it sees small caps doing well. (A Bloomberg Markets Live Pulse survey found 38% of respondents see equities accelerating a year from now under Trump, versus 13% under Kamala Harris.)

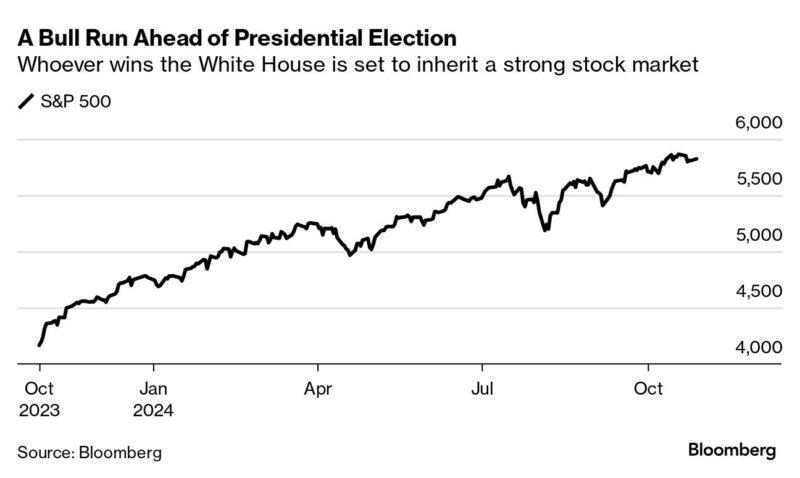

Whatever happens in the short term, the enduring equity rally is flashing good news for whoever takes the White House. Leuthold Group looked at previous episodes when the S&P 500 was showing similar momentum to the extreme readings it’s giving off today. It found that in 21 previous instances when the index was sitting on a gain of 30% or more over 12 months — it’s up more than 40% now — only twice did the economy falter in the next year.

Moreover, economic growth following the market’s high-velocity periods tended to accelerate further. As Leuthold Chief Investment Officer Doug Ramsey put it: “A strong stock market has tended to inoculate the economy against a near-term decline.”

One big caveat:

Control of both the White House and Congress by either party is likely to revive inflation and trigger a hawkish reaction by the Federal Reserve, a scenario that doesn’t bode well for risky assets, says Rich Weiss, chief investment officer for multi-asset strategies at American Century Investment Management. “The only way it’s not going to be inflationary is if you get a one party in the White House and Congress is locked in the other,” he said. “That would actually be a blessing.”

Stay safe and make today great!!!