Good Monday AM from your Hometown Lender,

Rate sheets this morning are worse, reflecting Friday’s losses for bonds and adding in this morning’s weakness. Reprice risk on the day is moderate, we could see bonds continue to drift lower and put lenders in a position to reprice worse. Although we’d love to be optimistic, between this week’s data and next week’s election and Fed meeting we could see rates take huge jumps if things don’t go our way.

It’s a brutal outlook.

This is a very busy week for data with expectations all over the place. The hurricanes are believed to have put a crimp into employment and we will get a glimpse of all of that throughout the week. Tomorrow will bring consumer confidence and JOLTS, Wednesday is ADP payrolls, Thursday is PCE, and Friday is the big daddy the BLS Jobs report. Reports in the morning as pricing starts to come out, and if we see more signs of economic and labor market strength like we saw last month we will see rates move higher. Wednesday brings ADP private payroll reports along with the third quarter revisions to GDP data. Thursday is jobless claims and PCE inflation data, capped with Friday’s big jobs report.

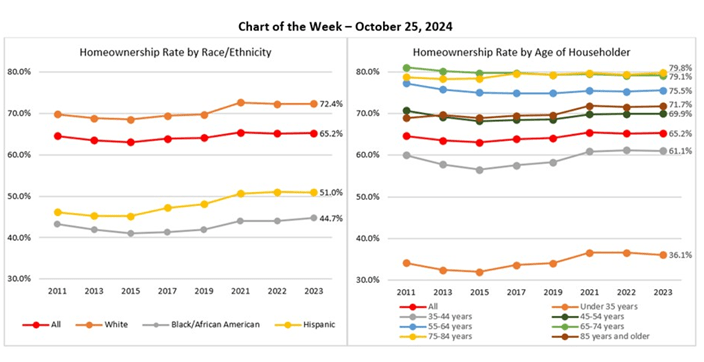

If you’re a geek like me and love demographics as I do, the below chart has a bunch to learn from. Surprising to me is that the homeownership rate almost doubles from the below 35-yr old cohort to the 35-44 cohort. That should tell us where to focus. Also, the homeownership rate for Hispanic’s is almost half that of White homeowners.

Looking to be surgical in your marketing? This should point you in the right direction.

Stay safe and make today great!!!