Good Thursday AM from your Hometown Lender,

A little data out today but it was not very helpful. Unemployment claims a little lower than expected, although continuing claims did jump to a record number. It’s odd that with two hurricanes that have decimated the southeast, claims did not increase. I am not getting on a conspiracy theory yet, maybe people haven’t made it to the unemployment offices yet…

Regardless, there needs to be some rationale for the data.

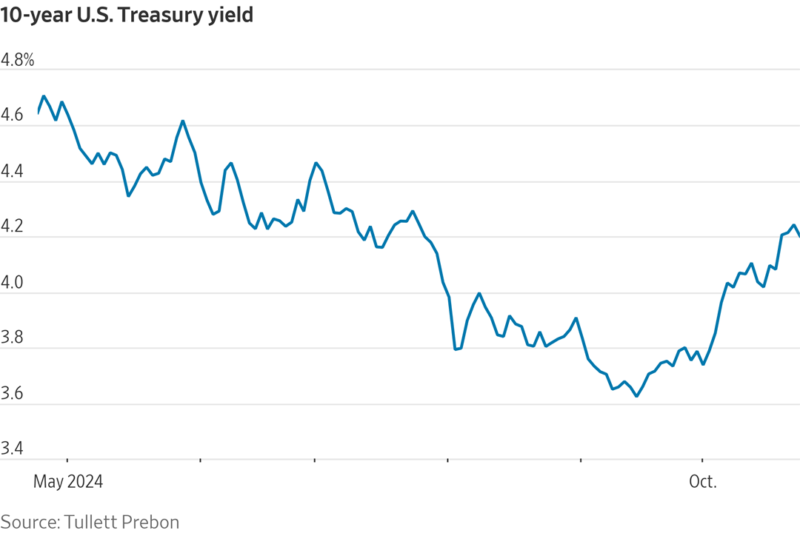

PMI came in a bit stronger than expected and New Home Sales beat expectations, although last month was revised lower. All in all, this was not bond friendly data though, with the selling that has been going on in the bond market, we are due for some buying. We are seeing a little buying this morning with the 10-yr down to 4.20% today and mortgage bonds are up a baker’s dozen.

Tomorrow is a State of Nevada holiday (Nevada Day) but markets are open.

A bit of relevant insights from around.

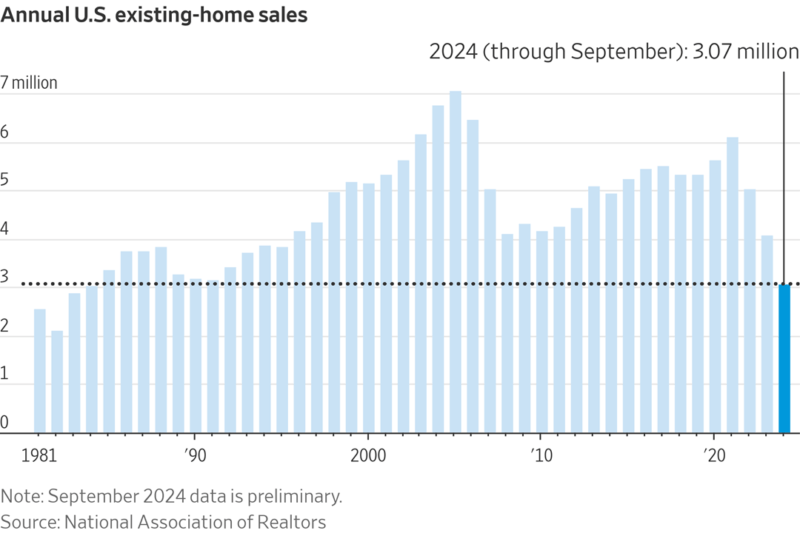

Sales of existing homes in the U.S. are on track for the worst year since 1995. Persistently high home prices and elevated mortgage rates are keeping potential home buyers on the sidelines.

The possibility of a Republican sweep and what that would mean for markets has emerged as one of the biggest themes this week.

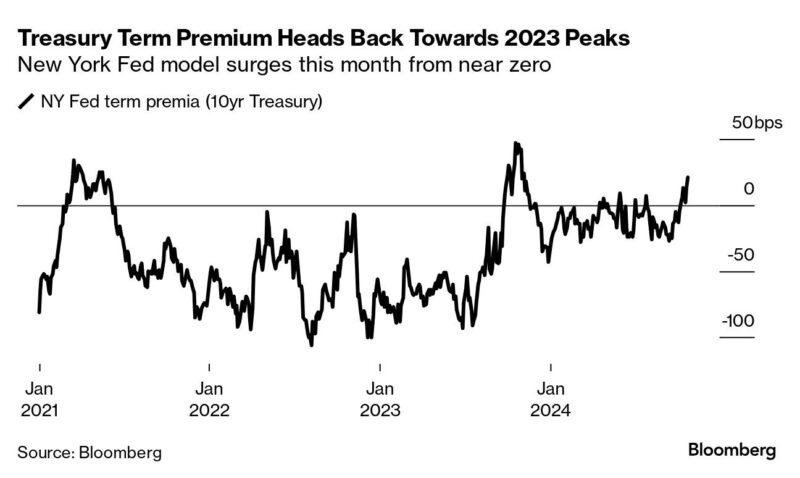

The hot metric of the moment is the surge in the term premium, typically described as the extra yield investors demand to own longer-dated Treasuries instead of rolling over T-bills. While it’s an esoteric indicator and one that can only be estimated because there’s no way to see what the average T-bill yield over 10 years would be, it’s still as an important measure of bond market risk.

If Republicans have full control over Congress and the White House, the thinking goes that they would usher in more spending and tax cuts — on top of the inflationary pressures of Donald Trump’s proposed tariff regime — at a time when US borrowing is highly elevated.

All that adds up as more fuel for a selloff in the Treasury market, already mired in one of its worst losing stretches of the year. Bonds are on course for their first monthly decline since April, with the 10-year yield headed toward 4.25%, though prices are steadying today.

Of course, there are other reasons for investors to sell bonds, especially as the strength in the US economy leads traders to price in a shallower path of Fed interest-rate cuts. And, as we wrote in Monday’s newsletter, election guessing is notoriously tricky and polls show the two candidates in a dead heat.

Stay safe, make today great!!!