Good Morning on this best day of the week Wednesday, from your Hometown Lender,

Bonds started the day in great shape with rates heading lower and as often happens when we hit the top or bottom of a trading channel, technical trading takes over and rates popped higher.

We were at the best levels of the year until about an hour ago.

President Trump is scheduled to share his new tariff structure from the White House Rose Garden at 4pm ET (the time now being shared, which is different than what was shared yesterday which was 3pm ET). Is it coincidence that he timed it at the close of stocks? Probably not.

There is a really good chance that when the tariff information is released it could push rates to new lows for the year, and dare I say heading back to those lofty September levels of last year. However, no one knows how this is going to play out, or how markets will react to it (both foreign and domestic, tomorrow). That means we will see both an immediate kneejerk reaction, as well as watch things play out further tomorrow. And, just when the dust starts to settle, we will get Friday’s BLS jobs data.

The next 72 hours has the potential to be volatile.

Here are a few more interesting pieces to digest regarding tariffs, the economy, credit spreads, and a recession.

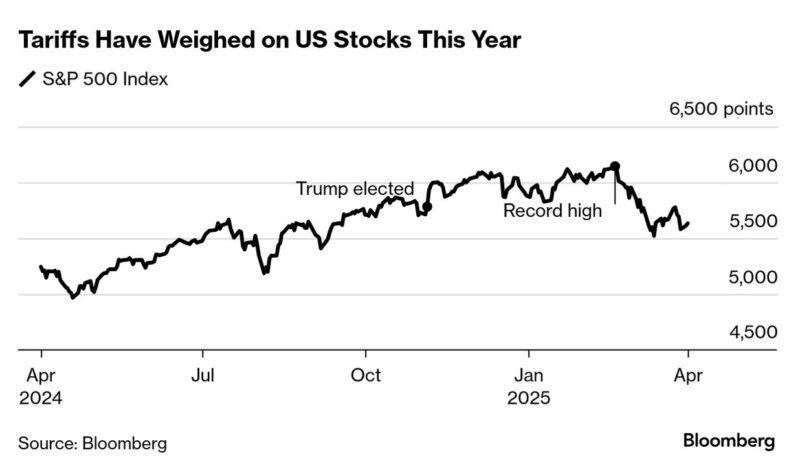

Wall Street trading desks disagree on many things, but there’s one view they now seem to share: President Donald Trump’s tariff announcement is likely to worsen the selloff in the S&P 500 Index, at least in the near term.

Firms including Goldman Sachs and Bank of America see the trade measures raising stock-market volatility and deepening the slide in the benchmark gauge, which just came off its worst quarter since 2022.

Trading desks, which analyze the flow of funds from institutional and retail investors to predict the market’s next move, are fretting that Trump’s trade war can cut into earnings and destabilize supply chains.

Stocks surged in the weeks after Trump’s election victory, with investors cheering his plans to slash taxes and regulations, while largely dismissing tariff threats as a negotiating tactic. Now, with the S&P 500 down 8.3% from its Feb. 19 record, the mood has changed.

“The bearish calls are getting louder across the floor and client base,” Goldman Sachs’ trading desk wrote in a note last week, pointing to a level of expected volatility this week that’s comparable to the US election in November.

JPMorgan Chase’s trading desk remains tactically bearish on stocks, citing policy uncertainty and the potential impact of tariffs on the economy. At Barclays, global head of equities tactical strategies Alexander Altmann said his main concern is that Trump’s announcement will leave room for interpretation, keeping trade policy in flux.

“Uncertainty is the killer of everything in markets,” he told Bloomberg News. “It kills investment decisions, corporate spending, as well as business and consumer confidence.”

Several desks warn that the S&P 500, sitting at about 5,600, has room to fall further.

Bank of America’s John Tully said the US benchmark could drop below 5,500, while a recent note from UBS said the stock gauge could sink to 5,400 if the White House implements 20% tariffs.

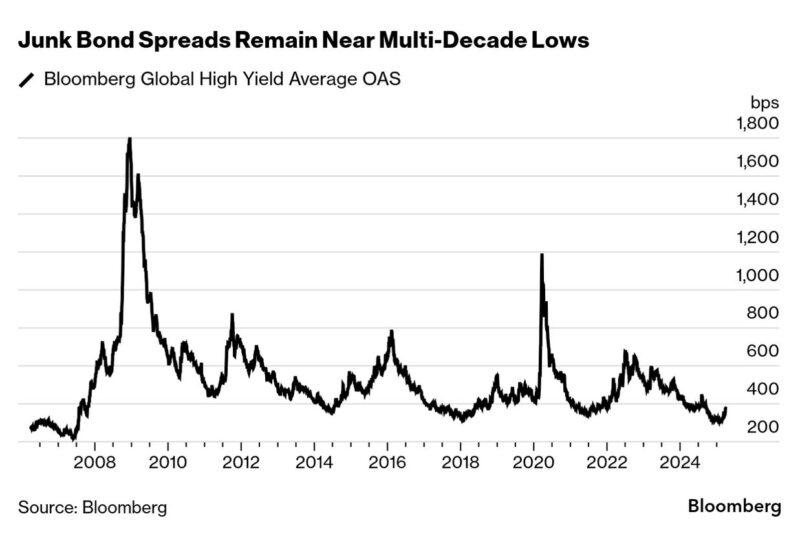

Investors are fretting that a year-long rally in global credit is papering over the risk that US policy uncertainty tips the world’s largest economy into a recession.

Some are sounding the alarm that this could be a “gray swan” event — a shock that’s predictable in theory, but largely ignored until it hits. Unlike black swans, which are truly unforeseen, gray swans lurk in plain sight.

In contrast to the selloff in other asset classes, very little bad news has been priced into credit markets so far. Just this week, banks pulled off a whopping €7.45 billion sale of junk-rated loans and bonds to finance a private equity firm’s purchase of a stake in Sanofi SA’s consumer health division.

“Credit markets in the US are pricing in a much lower chance of a recession than equity markets are and something has to give,” said Chris Ellis, a London-based high-yield portfolio manager at Axa Investment Managers. “I’ve heard it described as a ‘gray swan’ risk in the market, which seems apt to me. We don’t know exactly what could trigger a selloff, but we have to tread carefully.”

A model by JPMorgan Chase strategists showed in mid-March that the S&P 500 was pricing a 33% probability of a US recession, up from 17% at the end of November, while credit was only pricing in 9% to 12% odds.

In recent weeks, high-yield bonds have started selling off along with stock markets. March was the worst month for high-yield bond returns since September 2022 in Europe and October 2023 in the US

And yet, on a historic basis, spreads — the premium in yield over government bonds that borrowers need to pay — are still in very good shape. Typically, a junk bond spread of 800 basis points is seen as presaging a recession. Even after the recent selloff, they are less than half of that on both sides of the Atlantic.

Stay safe and make today great!