Good Thursday Am, from your Hometown Lender,

There is a bit of economic data out today but I don’t know it is going to get much attention. China left their rates unchanged, Switzerland cut by .25, the Bank of England left things unchanged and said global trade was uncertain and challenging, something that everyone knows. Unemployment claims came in on the number and Philly Fed manufacturing rose.

Fairly benign across the board.

It would not matter though, markets are digesting yesterday’s Fed statement which despite keeping rates unchanged with no commitment to when they will cut, the piece about higher inflation, and lower growth; the most helpful for our purposes is that the Fed will slow Treasury roll off from 25b to 5b per month. Less supply of bonds in the market will increase demand as will the fact that that the Fed will be buying more.

Rates should improve.

Here is a great commentary from Matt Graham:

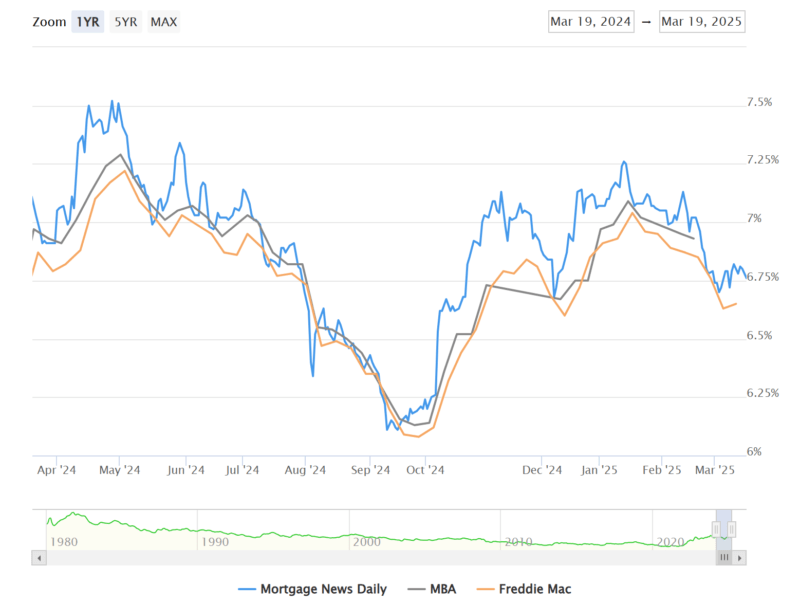

Heading into today, we knew the afternoon’s Fed announcement was biggest potential flashpoint for interest rate movement, and that the movement probably wouldn’t be extreme. The unknown, as always, was the direction of said movement. Thankfully, it was lower.

This wasn’t destined to be the case this morning. Out of the gate, the average mortgage lender was offering slightly higher rates compared to yesterday’s latest levels. After markets reacted to the Fed, lenders revised their rates to the lowest levels in just over a week (also fairly close to the low end of the range going back to mid October).

What did the Fed say/do to bring rates down?

First off, the bond market movement wasn’t big, even by the standards of a regular non-Fed day. That said, there was definitely a reaction to the Fed. Some of it had to do with the Fed’s rate forecasts staying fairly grounded despite concerns that recent inflation readings could push those forecasts higher.

In addition, the Fed made some changes to the way it handles the payments it receives on bonds it already owns. The changes will allow the Fed to reinvest more of those payments back into buying new bonds, and bond buying is good for rates, all other things being equal.

Stay safe and make today great!