Good Morning on this best day of the week, Wednesday (and Fed day), from your hometown lender,

Yes, it is Fed Day.

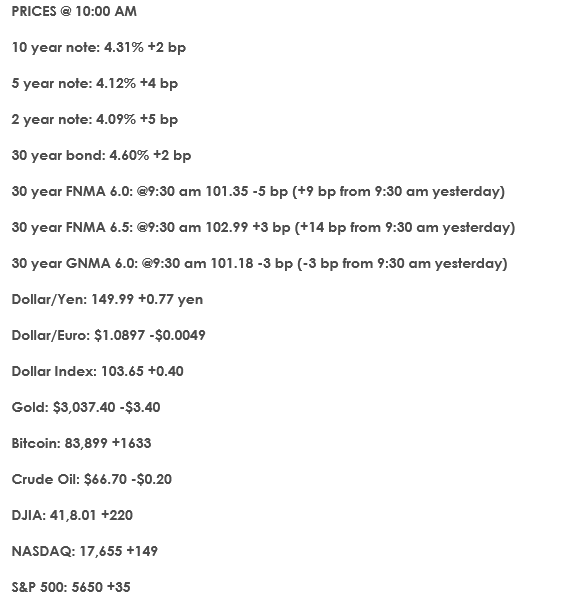

The Fed will release its policy statement at 11 am, when it is almost assured to leave rates unchanged, but it is the dot plot that will get the most scrutiny. The dot plot is the anonymous forecast of each of the 19 Fed members on where they think rates will end the year for 2025, 26, 27 and longer. We may see an initial reaction in bonds shortly after this comes out, but we can expect more movement during Fed Chair Jerome Powell’s press conference that follows, starting at 11:30. Bonds usually having the strongest reaction after the prepared remarks and a few questions.

If Mr. Powell talks more about the inflation risks of tariffs (which is unlikely) and less about the slowing economy…

We will see bonds lose ground today. It could kick off a further trend of rates creeping higher through the end of March with little hope of reversal until the labor market data comes out the first week of April. If we get a dovish Mr. Powell who is not scorned by President Trump, and economic growth is important (keep in mind, the Fed mandate only refers to 2% inflation and full employment, but not growth), rates will improve.

The one component I am hopeful for is…

That Mr. Powell reduces the amount of bonds the Fed sells every month to reduce its balance sheet. It is unnecessary to reduce the balance sheet (the debt is already outstanding, why do we need to sell it off?) and continues to cause losses to the Fed (the value of the 1% interest rate bonds is much lower today than when issued. Doing so (reducing bond sales) will limit supply, push demand up and rates down. Treasury Secretary Bessent is an outspoken proponent for lower rates, so hopefully he can collaborate with Mr. Powell to make a meaningful impact on rates.

That said…

Knowing Mr. Powell will focus on inflation, there is a chance we could see that markets are a little over the skies expecting too much help from the Fed and rates move higher after the Fed meeting. I hope not and do think we will get some good news but it is volatile.

How about this for a fund Medicare stat…

More money is spent on processing Medicare claims than the amount spent on Cancer treatment… to the tune of 20b/yr. Sound like there a little fraud in the system?

Stay safe and make today great!