Good Monday Am on this St. Patrick’s Day from your Hometown lender,

Are you wearing Green?

This is Fed week. Enough said. I do not expect markets to move much until the Wednesday announcement and I do not expect the Fed to cut rates however, in light of the recent weak economic data and political volatility (including today’s that I will get to shortly), you have to expect the Fed to acknowledge a slowing economy and discuss rate cuts coming to a city near you soon. I do not expect the Fed to make anything other than a passing commentary about equity markets, but I would think that if the Fed does set expectations for rate cuts, the equity markets should rebound.

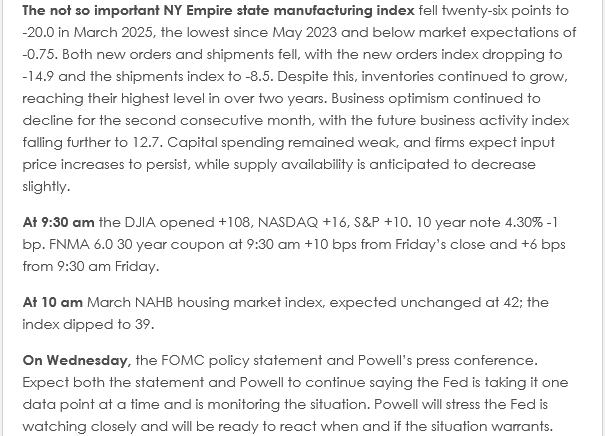

I know most people don’t like numbers as much as I do but when the data is so far out of expectations, as it was today, it is worth a look…

- Retail Sales in at 0.2 vs expectations of 0.7

- Retail sales Ex Autos in at 0.3 vs expectations of 0.5

- Empire MFG in at -20 vs expectations of -1.9

- NAHB index in at 39 vs expectations of 42

Rob Chrisman had some good insight today (albeit a bit more technical)

With the flight-to-quality trade taking hold in the wake of tariff uncertainty, financial markets have been adjusting forecasts and expectations amid heightened uncertainty resulting from the new administration’s economic policies and layoffs. The latest inflation data, which predates recently implemented tariffs, showed prices were softer than expected in February. The Consumer Price Index rose 2.8 percent on an annualized basis, down from 3.0 percent at the end of January as increases in both food and energy prices eased. Shelter inflation saw its slowest annual increase since 2021, rising 4.2 percent from the prior year. Price increases for services are expected to moderate as wage pressures ease and rental price growth slows, however increased tariffs are expected to increase prices on goods which could hamper continued progress on overall inflation in the near term. It’s possible the FOMC could view tariff price effects as transitory and continue to put more weight on the labor side of their dual mandate when making future monetary policy decisions. For the moment, the market doesn’t expect a rate cut until June.

Keep in mind that the PCE Price Index is the Fed’s preferred inflation gauge, and it has a slightly different methodology than CPI and PPI. There is some chatter out there that the PCE Price Index may not reflect the positive surprises we saw in CPI last week. And yes, all eyes are on the Federal Reserve this week, with the central bank scheduled to deliver its second interest rate decision of the year. With no changes to rates expected, the real focus will be on the updated dot plot and Chairman Powell’s press conference. Psychology and sentiment figure into mortgage rates and pricing, and both have been slammed by U.S. President Donald Trump’s back-and-forth on tariffs and trade war escalation. Additionally, growth prospects for the world’s largest economy have soured. Traders will be looking at the dot plot to get an idea of the Fed’s growth projections and will be keenly watching for any commentary on tariffs from Powell.

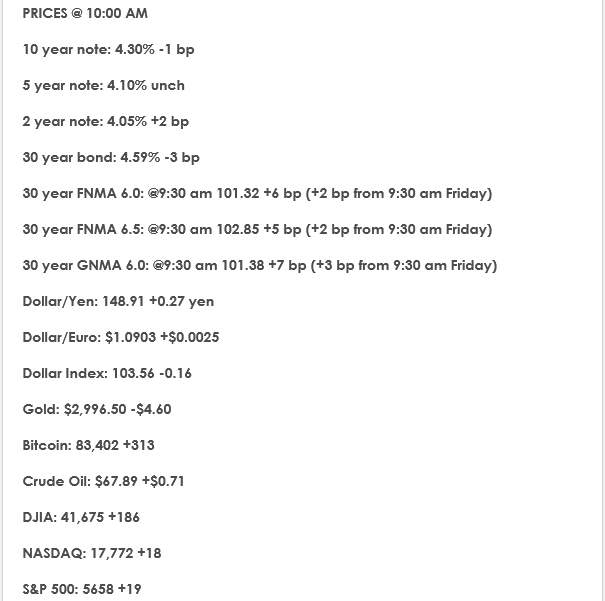

This week brings those aforementioned FOMC events on Wednesday afternoon, but besides the Fed, markets will also digest the latest decisions from the BoJ, the BoE, SNB, and Sweden’s Riksbank. Economic data of interest includes retail sales, business inventories, Fed surveys, housing-related data, import prices, and industrial production/capacity utilization. Besides bills, Treasury supply will consist of $13 billion reopened 20-years and $18 billion reopened 10-year TIPS. Regarding MBS, Class C and D 48 hours are tomorrow and Thursday, respectively. February retail sales (+.2 percent, lower than expected, ex-auto and gas +.5 percent, as expected) and Empire manufacturing for March (-20!) kicked off today’s economic calendar. Later today brings business inventories and the NAHB Housing Market Index for March. We start Monday with Agency MBS prices roughly unchanged from Friday’s close, the 2-year yielding 4.03, and the 10-year yielding 4.29 after closing last week at 4.31 percent.