Good Tuesday AM from your Hometown Lender,

We are three weeks and one day from Christmas and Hanukah…

And while normally at this time, I am starting to feel the market slowing down, this year I don’t. Maybe it is all the political dust being kicked up here at home and also at every corner of the world (too many to mention, but think: Presidential Pardons, Presidential Appointments, Tariffs, Wars, Coups, and the list goes on), or maybe there is a bigger focus on economic data which will guide the Fed’s rate policy, or maybe we are just used to this lackluster pace for long enough that we have accepted it as normal, or maybe there are other reasons but, whatever they may be, it doesn’t feel slow.

Limited economic data yesterday and again today has the market giving back a little of the recent rate improvement.

The 1-yr note was pushing 4.50% just the week before Thanksgiving and is currently at 4.22%. If the past has taught us anything it is to strike while the iron is hot. There is a lot that could change the lens on rates and push us back into the mid and higher 4’s. Not the least of which would be stronger employment data when released this Friday and any Fed commentary as a result. Rates could whipsaw higher, and markets would be back on the heels of a 5% 10-yr note. That would push rates back into the high 7’s. I believe the better choice is to buy and lock now. If rates drop, float down or refinance, but how long will people wait on the sidelines?

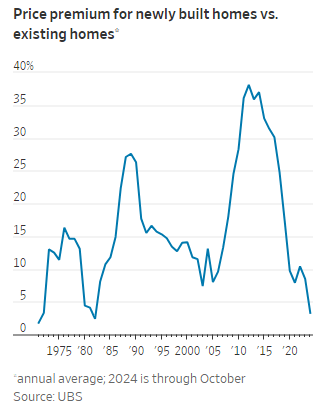

The WSJ had a surprising piece on the cost of new homes vs resales (keep in mind that the premise is a resale that needs to be upgraded) and does not take into account so many of the cost of new home ownership (landscaping, window coverings, etc.. ).

The new-home premium bounces around but has been 16% on average since 1968, based on data from UBS housing analyst John Lovallo. It has withered away since the pandemic-era housing boom, though. This year through October, buyers have paid a 3% premium on average for a newly built home. The last time the figure was so low was back in the early 1980s, when housing also was very unaffordable.

Stay safe and make today great!!!