Good Morning on this fantastic Monday from your Hometown Lender,

Lots going on, of course.

We have some data this week but if the bond market didn’t move positively last Friday on an absolutely horrible jobs report (a mere 12k jobs were added during the month and the unemployment rate moved from 4.05 percent to 4.14 percent. Jobs gains were revised down 31k in September and 81k in August, reaffirming that overall job growth has moderated. Had the government not hired 40k people last month, reported jobs would have been negative), no data this week will move markets.

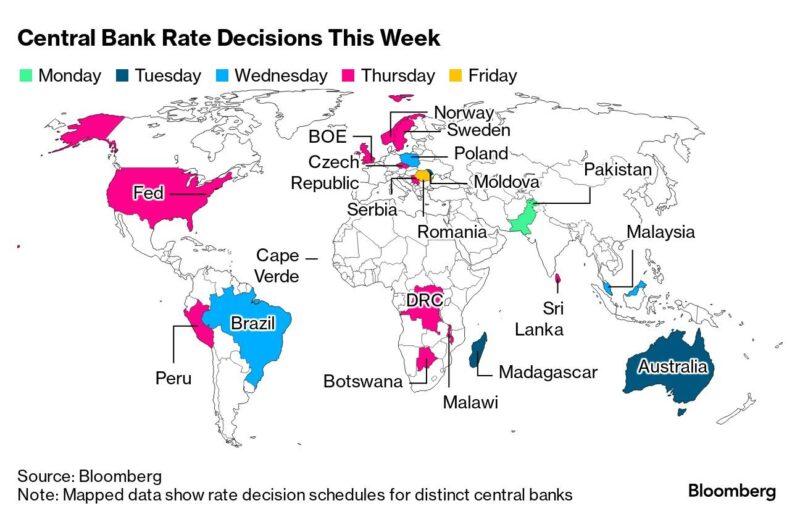

The election tomorrow, though, will as will the Fed’s rate decision on Thursday.

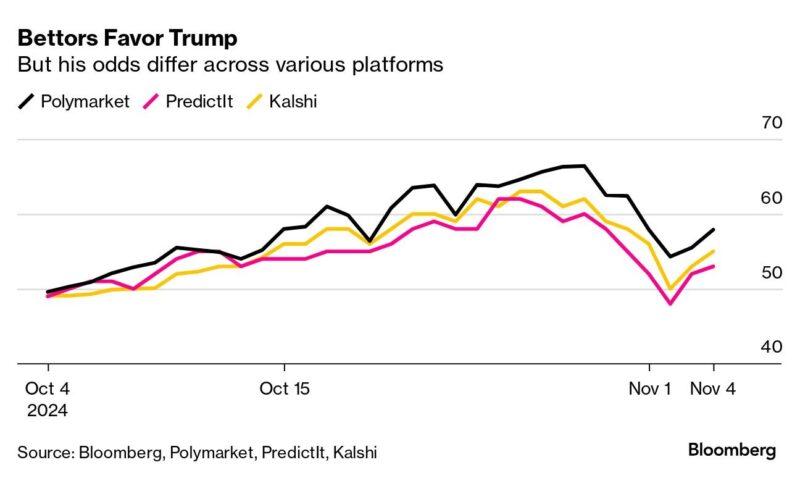

There were lots of polls out this weekend that seem to suggest Harris is in the lead. As a result of a potential Harris win and the possibility of less inflationary policies, bonds are improving and paring back some of last week’s losses. The 10-yr note yield is down to 4.32% from 4.40%. Despite the polls, the wall street is still wagering on a Trump victory (which is why bonds are not improving more). This is part of the Trump Trade that everyone has been hearing about but what does the Trump Trade really mean?

Here are some things that have been touted as a “Trump trade,” a bet on Donald Trump winning the election:

- Buy Trump Media and Technology Group (DJT), which runs his favored social media

- Buy bitcoin, gold and the dollar

- Sell Treasurys and the Mexican peso

- Buy healthcare and prison stocks; sell clean-energy stocks

- Buy European defense stocks

- Buy banks, especially regional banks

- Buy U.S. stocks while selling the rest of the world

It is also a busy week for lots of other central banks. Pakistan was the only country to meet today… if you are interested, they cut their bank rate by 250bps (2.5%) down to 15%… We look pretty good from that vantage point.

Stay safe and make today great!!