Good Tuesday AM from your Hometown Lender,

Yesterday was a brutal day…

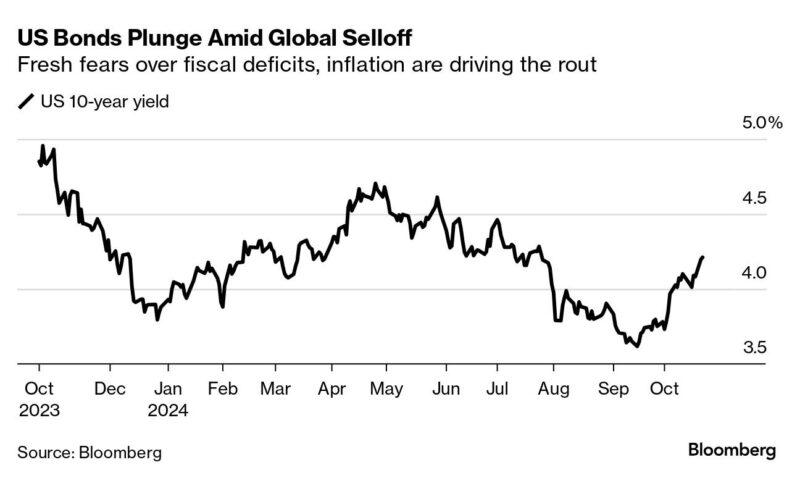

And with no top tier economic data released today, we will wallow in yesterday’s pain. Rates jumped an average of a quarter point on most rate sheets. Remember that although mortgage rates aren’t tied to the 10-yr Treasury yield, it’s a solid indicator for where they are headed or how bad it will get… and the 10-yr started October at 3.73 and ended the day yesterday at 4.20, hitting that level for the first time since July.

Bonds are selling off around the globe, and the outlook for mortgage rates has turned from positive to negative, although there is no reason we can point to currently. Maybe odds-on post-election inflation, maybe unexpected economic resilience, maybe too much corporate debt released into the market or maybe any number of other reasons are the culprit. We can probably look back at some point to see why.

A few thoughts from one of the sources I follow. I think the second bullet point resonates:

Traders are questioning whether they got carried away in a rally fueled by optimistic bets that the Fed would have to cut rates more than it thought, faster than it thought. Markets are now adjusting to the reality (or at least the current perception of reality based on the questionable economic and labor market data) that the Fed may not only not cut more than thought, but may actually cut less than thought. Here are some of the reasons we’re seeing a bond market selloff…

- After coming out swinging for the fences with a half point rate cut in September, Fed officials have thrown water on the fire with many officials out there calling to leave rates alone and to keep any cuts as “gradual”.

- Markets were looking for (and pricing in) at least .750 in cuts by the end of the year, and that is now falling to maybe only a single .250 cut. While still penciling in a 90% chance of a Fed rate cut to come in November, chances of even a .250 cut in December are now below 70%.

- The labor market is proving more robust than expected… if you believe the data. Many of us don’t. This is especially scary since we have another report coming before the election on November 1st, and if you think that one month’s data might have been over-adjusted it stands to reason that a second month right before the big dance would likely be over adjusted as well… (and this would be very bad for mortgage rates).

- Fear that inflation will come back. This one gets pinned more to Trump than Harris, due to his stance on tariffs and looser fiscal policy, at least in the headlines. The reality is regardless of who is mowing the White House lawn we are likely to see increased budget deficits and sink deeper in debt.

The point is that Bonds markets are reeling from the risk that the Fed won’t cut interest rates as much as expected.

The 10-year Treasury yield rose above 4.2% for the first time since July, setting off a surge in borrowing costs from Australia to Germany. A gauge of expected debt-market volatility, called the Ice BofA MOVE index, is now around its highest of the year.

The WSJ shared that:

Once again, it looks like bond investors got carried away with a rally fueled by optimistic bets for easier monetary policy — only to be hit with the reality that change may not happen as quickly as they would like. It’s a pattern that played out on repeat for the past two years.

Here’s some of the reasons behind the bond market selloff this time around:

- Traders are rethinking the path of US interest rates. A repeat of September’s half-point cut is already off the table. Torsten Slok of Apollo Management sees a rising chance that the Fed will hold rates in November and others think policymakers will skip in December. On Monday, Fed officials indicated to varying degrees that they plan to take rates lower, but perhaps more slowly than anticipated.

- The US jobs market is strong. The economy is proving more robust than expected. The Bloomberg Economic Surprise Index, which captures when data exceeds economist forecasts, is at the highest since May.

- Threat of faster inflation under Trump. The presidential race is still a coin-toss with two weeks to go, but Republican Donald Trump has the advantage over Democrat Kamala Harris in betting markets. His support for higher tariffs and looser fiscal policy has been seen as unfriendly to bonds because it means faster inflation and more debt.

- Budget deficits are getting bigger. The International Monetary Fund, which is holding its annual meetings in Washington this week, already predicts US debt will surpass 100% of gross domestic product next year. Deutsche Bank analysts also forecast the budget deficit will be between around 7% and 9% from 2026 through 2028, regardless of whoever is in the White House. The greater the deficit, the greater the issuance of bonds

There will be good news tomorrow.

Until then, stay safe and make today great!!!