Good Monday Morning from your Hometown Lender,

Not much economic news to speak of today but bonds are nonetheless getting shellacked.

The 10-yr is up to 4.18% and mortgage bonds are off 45bps. There are several Fed speakers out today and at least one, Lorie Logan, is questioning the Fed’s next move in November. Although not directly, markets are interpreting her comments as the Fed should not cut again in November. Until there is an opposing view calming things down, this elevated volatility will persist.

It is a busy week for corporate earnings…

Which will likely add gains to the stock market, but there is not much for economic news for bonds to digest. Increases in stocks indices could put pressure on bonds as the risk on trade continues. Not a great day to be floating, but if you are already here, I don’t think I would close the barn door after the horses have gone.

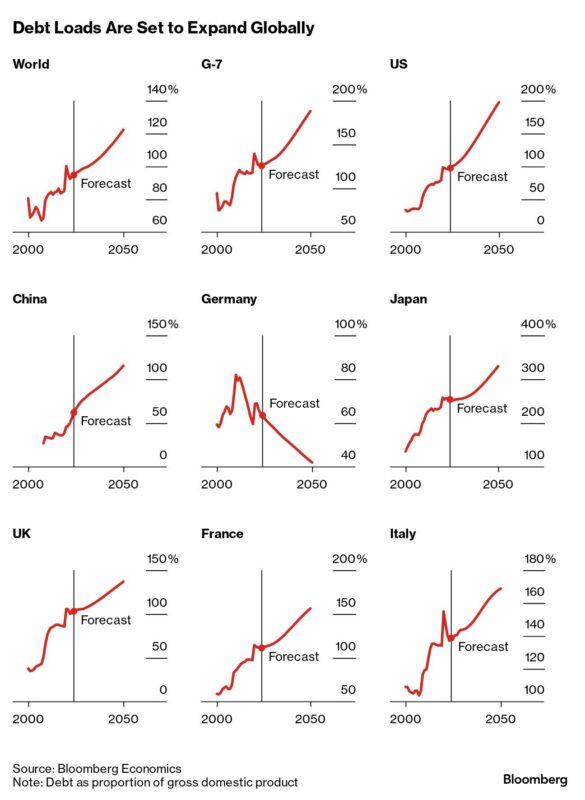

This infographic is very interesting…

Only one country is making progress on debt load and that is by making the hard choices to spend less. How do we combat 200% debt to GDP? How do we leave this to our children?

No candidate is discussing this.. I wonder why?

Stay safe and make today great!!!