Good Thursday Morning from your Hometown Lender,

The CPI inflation data came in hotter than expected…

But bonds didn’t have a strong reaction to it and it didn’t hurt rate sheets. This is an example of how markets are fixated solely on jobs data right now, since the Fed has expressed that it is comfortable with how inflation is coming along but was concerned about jobs. A couple of months ago an inflation report that came in slightly hotter like this one sent bonds selling off and ruined rates. This time it got yawns.

Jobless claims, which come in weekly and are usually not a big deal, got a stronger reaction today because they jumped to the highest level since August 2023. The jump is being blamed on unemployment applications is being blamed on Hurricane Helene, but it seems a bit stupid to me as I live in the Western North Carolina area and we had no power, no internet, and no cell service for all of these applications to be filed… but why should common sense make it into the conversation?

Lorie Logan, president of the Dallas Fed, says in a speech that easing policy too quickly could create excess aggregate demand and risk reigniting inflation. “These risks suggest the FOMC should not rush to reduce the fed funds target to a ‘normal’ or ‘neutral’ level but rather should proceed gradually while monitoring the behavior of financial conditions,” Logan says in the published text of a speech at an energy conference in Houston. Meanwhile, job gains have slowed but overall the labor market remains healthy, she says. Logan is not a voter on the rate-setting Federal Open Markets Committee this year.

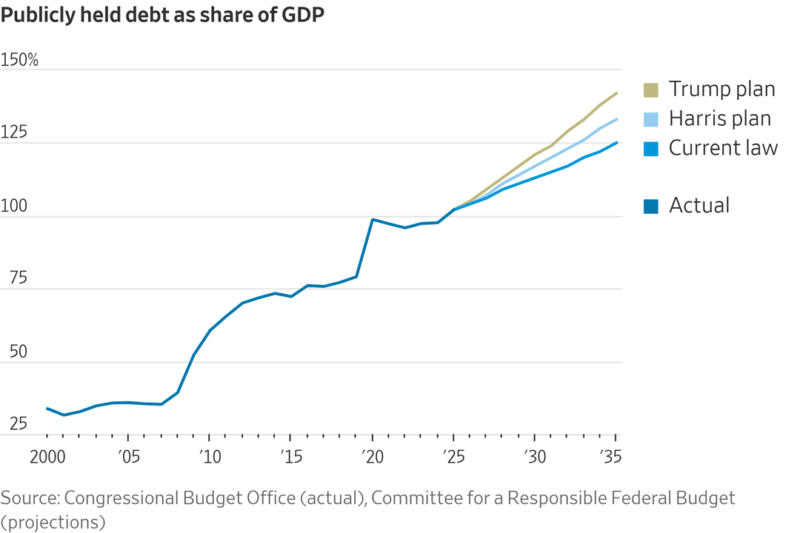

What are the expectations for rates depending on who wins the election?

The Federal Reserve three weeks ago slashed its short-term rate target by half a point and signaled more cuts to come. Yet in that time, investors have pushed the yield on the 10-year Treasury to 4%, the highest in two months.

Why would long rates rise while the Fed’s rates fall?

The Fed sets interest rates for the immediate future. Investors are betting on the path of those rates for the next decade. And for two reasons, interest rates are likely to be higher, perhaps much higher, in the coming decade than in the prior one.

- One of those reasons is relatively benign. Inflation and growth won’t be as low as before the pandemic.

- The second is much less benign. The federal debt is on an unsustainable path, which might become even more perilous after the election, especially if former President Donald Trump wins and Republicans take control of Congress.

Stay safe and make today great!