Good Monday Morning from your Hometown Lender,

This is the final week for data…

Before next week’s Fed meeting where Mr. Powell will announce a rate cut (and set the stage for future cuts). Does the Fed cut by 25bps or 50bps? That decision is going to be influenced by this week’s inflation data for sure. Wednesday, we have CPI and Thursday is PPI. Assuming those come in as expected with CPI at 3.2% and PPI at 2.2%, I think the Fed opts for a 25bps cut and rates worsen as a result. Markets are already pricing in more than the 25bps cut and while it is not unheard of for the Fed to make a first cut, 50bps, it is not the norm. If the inflation gauges come in below expectations, I think it will be tough for the Fed to not cut 50bps which should keep a bid to bonds (rates heading lower).

The next hurdles will be the set up for future cuts.

Markets are still expecting 100bps of cuts through the end of the year. If we only get 25bps in September, we will need 50bps at either the November or December meeting. Possible for sure but it will cause a bit of anxiety in markets. The third hurdle is what does the Fed do about their bond sales, I have mentioned that to me, this is the biggest component of why rates are artificially high. The spread on the 30-yr mortgage to the 10-yr note is still 275basispoints which is 100 basis points higher than the historical norm. The Fed is selling bonds into the marketplace creating more supply. If the Fed were to say they are going to taper their bond sales, rates will improve right away. That last part is what I am most hopeful for with next week’s meeting. It’s important to mention that the 2-10yield curve which had been inverted for some 500 days un-inverted last Friday. The 2 -10 yr inversion is a widely used recession forecasting tool, but most do not realize it is not when the curve inverts that recessions start, it is when the curve un-inverts.

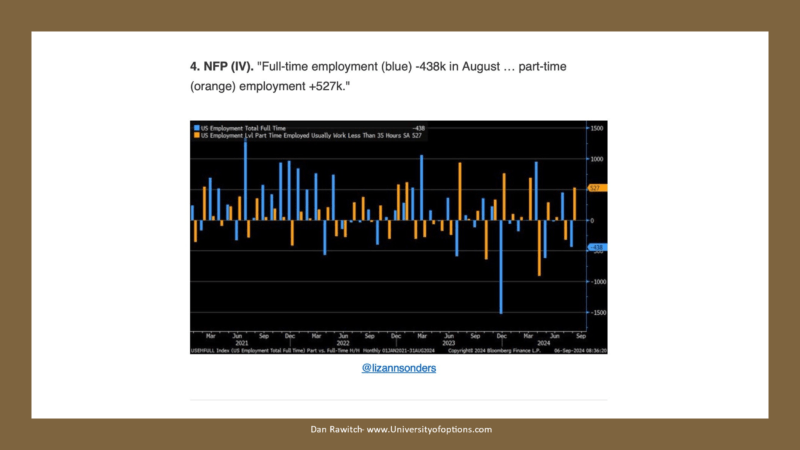

A couple of quick slides to have a better idea of the current employment picture.

Full time employment dropped by 438k while part time employment jumped by 527k. As you are already thinking, that is not good for our economy.

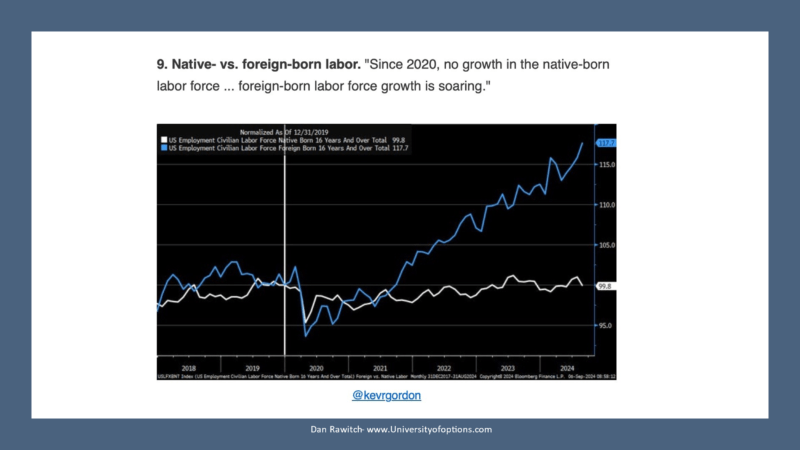

And this slide goes right along with the one above.

Foreign Born Labor includes both the legally immigrated and the illegally immigrated. Illegally immigrated employment adds limited (being gracious) value to the economy as more money is spent on services than the income brings in.

Last, this was an interesting quip…

If you clicked on a real estate agent’s name next to an online listing, don’t hold your breath waiting for a call. Nearly half of online property inquiries are simply ignored, according to new research from real estate analyst and consultant Mike DelPrete.

Stay safe and make today great!